Domistock Tools Used:

Assets mentioned: Light Crude (CLC1)

There is no question the current oil rally has so far been impressive and DomiStock’s “go long” signal managed to provide some outstanding returns of between 18.83 -22.84% (depending on whether the entry point was at the 3rd of August when the “go long” signal was given as a hedge or at August 4th when it was given as the dominant one). However, according to DomiStock there are now 3 technical signs and a double resistance that point to a potential short term correction.

1. The 5-day Max Profit / Loss Calculator forecasts almost equal profit and loss potential which points to diminishing demand for oil in the short term.

2. In the last 100 periods there has been no other 13-day “go long” DomiStock signal returning a higher than the current profit, which is an indication that oil’s performance entered statistically extreme levels

3. In the last two sessions, oil’s price has been called modestly inflated* for the first time since June. The previous time DomiStock called oil price inflated, a correction followed.

* Getting a rate of 1 on the inflationary scale (with 3 being the most inflated)

Apart from the above, DomiStock automated support & resistance charting tool, charted not one but two resistance levels ahead for oil, at $50.54 and $51.67, with both resulting in important price corrections when last tested.

+2 signs from hourly – data charts

By turning to the hourly -data chart, we spot a couple of additional warning signs about oil.

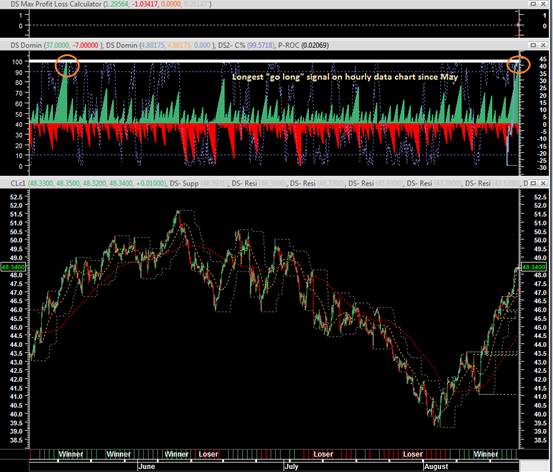

1. There is a 7-hour “go short” as a hedge signal given by DomiStock, so as to protect profits from the 37-hour “go long” signal which is the current dominant one. Unless that hedging signal is canceled, it will spill over to the daily chart, creating a bigger problem for oil.

2. Last but not least, the current DomiStock long signal on the hourly data chart, is the longest since May, which, again, is statistically extreme and a sign of time inflation.