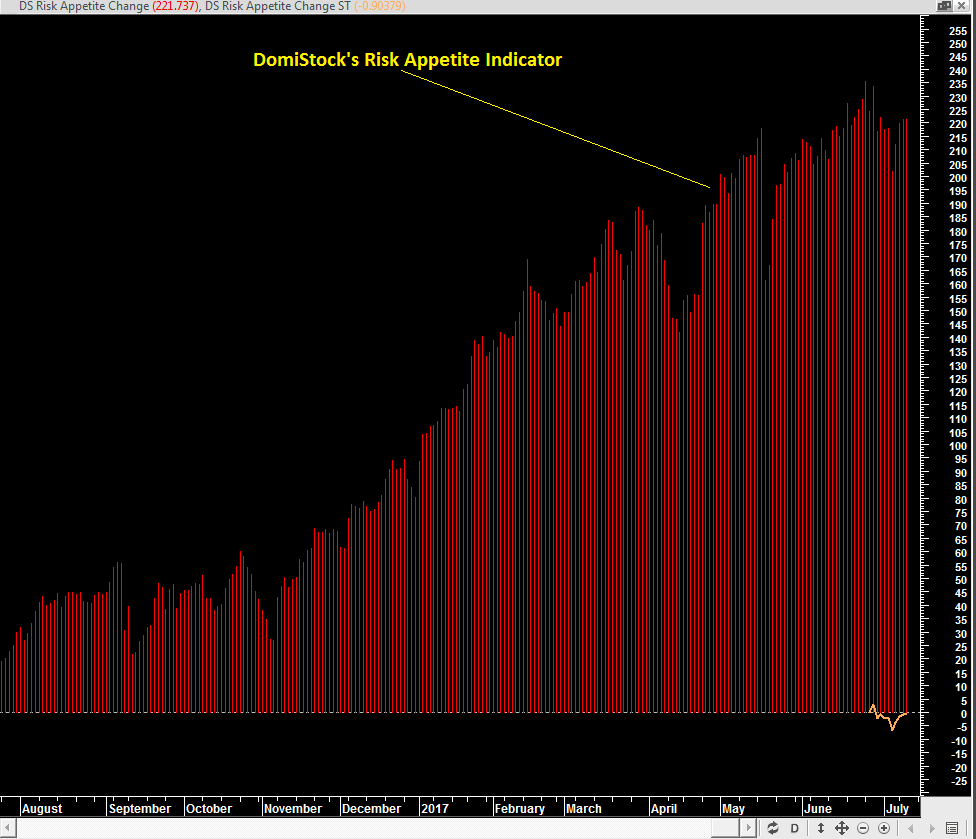

Assets charted: DomiStock’s Risk Appetite Indicator

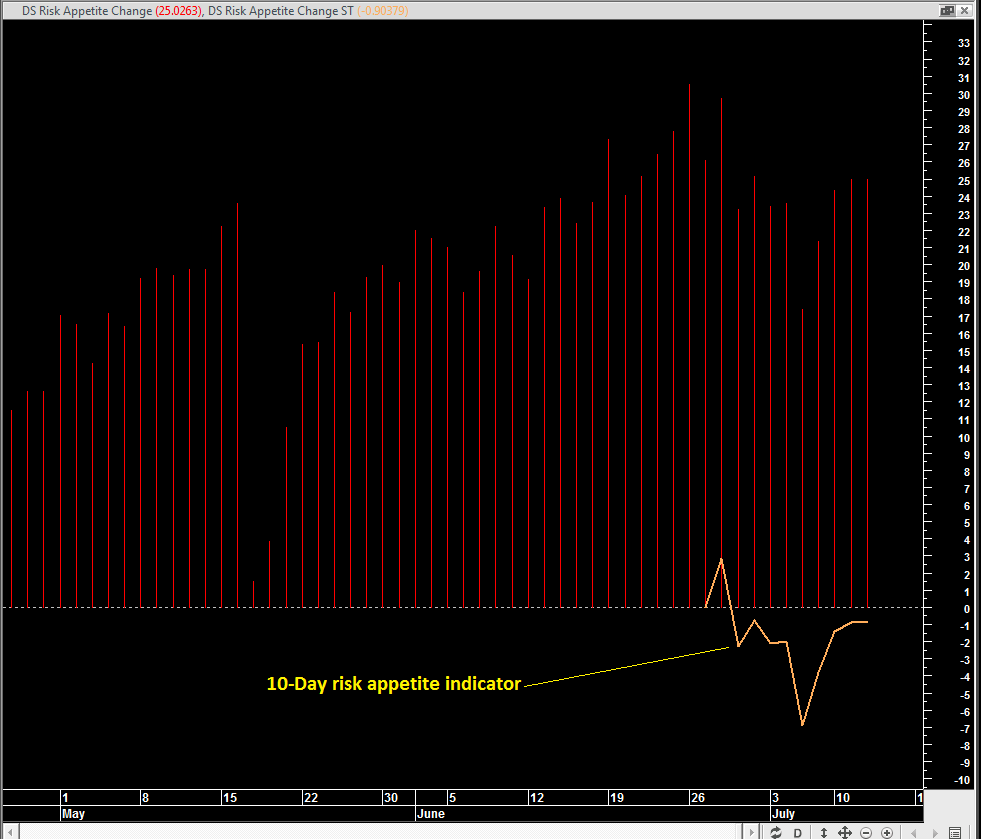

DomiStock’s risk appetite indicator hit a 4-year high in late June and has retraced a bit since. The 10-period risk appetite indicator sunk to negative territory but is making a comeback. Still, it needs to climb above zero to confirm risk appetite refueling.

DomiStock’s Cross Asset Screen: Commodities rank 1st in the last ten periods, followed by S&P 500 and Global stocks. Dollar and bonds on the downside, global real estate the bigger loser S&P 500 climbs within 1% of an all-time high as Yellen speaks. DomiStock drawn symmetrical triangle broke in the upside. Nearest resistance at 244,38. Dominant & Hedging Signal System shows inflows for 4th day in a row. Dominant & Hedging System sees and upward, established and expanding short term trend.