Domistock Tools Used:

Assets charted: International ETFs, EWI

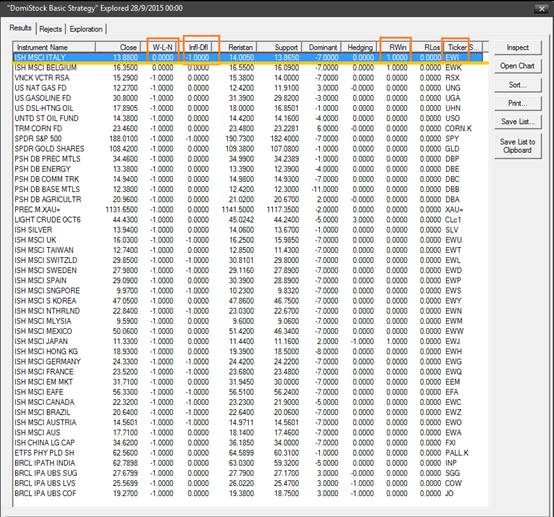

In search for trading opportunities around the globe I used DomiStock’s Trading Strategies Tools Exploration to scan 26 of the most widely used international ETFs. The ETF that emerged out of the exploration as the only one fitting one of DomiStock’s three basic strategies was the one for Italy – the “EWI”. In column b of the exploration table we see that EWI comes up as neutral (0 stands for neutral, 1 for winner and -1 for loser) and deflated (Column C: negative values indicate a deflated security, positive values an inflated one and 0 means the security is neither deflated nor inflated). This means that EWI is candidate for the “Long the Deflated Neutral” strategy.

EWI is also a Recent Winner (see one column before the last one at the exploration’s table). That makes it potentially deflated in the medium term and is an additional positive technical sign. Now, for a closer look at EWI lets chart it using the DomiStock Fast template.

In DomiStock’s quick manual we read that the “Long the Deflated Neutral” strategy “is of medium to high risk and looks to long securities that:

1. Are neutrals

2. Are deflated

3. Are testing / holding important support levels

4. Have a positive Dominant or Hedging Signal

By applying the DomiStock Fast template on EWI’s price we can see that after falling for quite a while it is now testing critical support. Hence condition number 3 of the “Long the Deflated Neutral” strategy applies in this case. The red dot and the “1” drawn under EWI’s last bar indicates that its price is deflated and that satisfies condition number 2, whilst on the bottom right of the chart we read that EWI is a “Neutral” and that satisfies condition number 1. So three out of four prerequisites of the “Long the Deflated Neutral” strategy apply in the case of EWI when looking at a daily chart.

Additionally, the current “go short” DomiStock signal that is intact for 7 sessions has been too strong, returning 8,26% while the C% indicator has fallen in deflated territory, with both these technical events supporting the case of am EWI drop that has been overextended. Last but not least, the 2-Day, 35% Probability Resultant Direction of the Max Profit Loss Calculator has turned positive, which indicates a diminishing of the supply.

To wrap it up, three out of the four prerequisites of the “Long the Deflated Neutral” strategy are intact and a few more that support a “go long” signal in the making. What is missing is a positive Dominant or Hedging signal but even that has already started appearing on the hourly chart. In advanced DomiStock theory, the combination of charts of different timeframes is allowed as long as the necessary precautions are taken, like a careful stop loss. In the case of EWI a stop loss can be set just below the nearest support level automatically detected by DomiStock or a bit lower, just below the critical support of July’s low.