Domistock Tools Used:

Assets charted: S&P 500 ETF (SPY), WORLD STOCKS ETF (VEU), CRB COMMODITIES INDEX (. CRBQX), US DOLLAR INDEX (.DXY), US 7-10 YR TREASURY ETF (IEF), GLOBAL REAL ESTATE ETF (RWO).

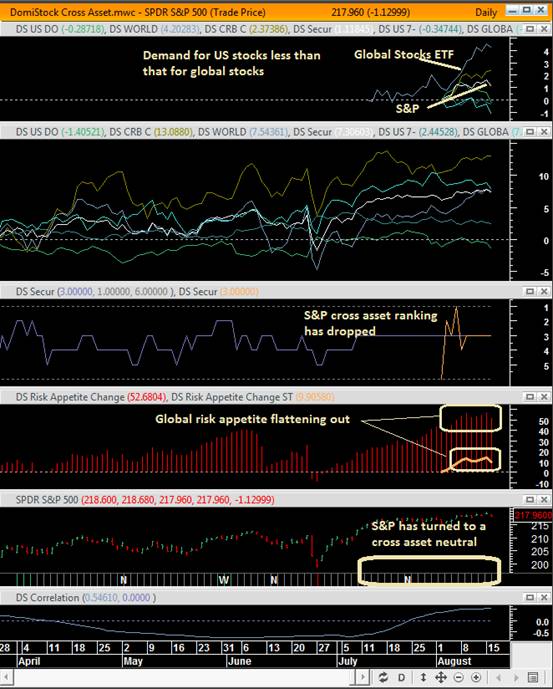

Global risk appetite has been strong, providing the necessary demand to push global and US stocks higher. Yet, the DomiStock’s global risk appetite indicator, which starts from zero and measures in percentage points the change in investors’ appetite for risk assets, has been flattening out in both the 100-period and 10-period timeframe. One of the main drivers for that seems to be the US stocks. Indeed, although S&P 500 has reached fresh highs, its short term performance relative to that of global stocks ETF, “VEU”, is by far weaker, pushing its cross asset ranking down to number 3 from a recent number 1. That is the reason why the DomiStock’s cross asset winner / loser ribbon has marked S&P as a cross asset neutral. These cross asset changes translate to a probable drop in demand for stocks, especially in the US and that might create a barrier for further gains for S&P for now.