Assets charted: International ETFs

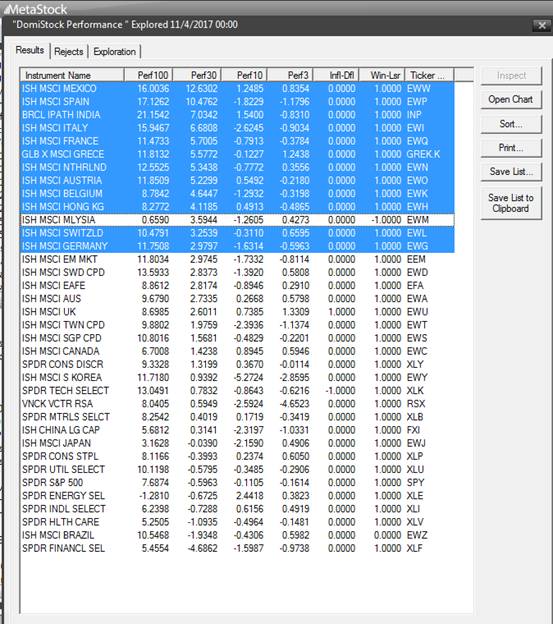

Let me talk to you about an amazing DomiStock tool, the DomiStock Performance exploration. It filters securities according to their performance in the last 100, 30, 10 and 3 periods. The exploration also scans for securities whose price is inflated or deflated (column E) and which are winners, losers or neutral (column F) and returns the score points (with 3 being the highest inflated and -3 the highest deflated) of inflation or deflation (column E). If the price is neither inflated or deflated, then the scan returns a 0 value (column A). This exploration works with Daily or Intraday data.

What I am looking for is securities that are winners (hence the value of the last column to the right is “1”) but that are either deflated, i.e. cheap or are consolidating, i.e. their 3 or 10 period performance is negative or close to zero. I prefer securities with stronger 30 period profits as long as they are not inflated.

I scanned the top 10 US sector ETFs and the top 25 International ETFs and I have highlighted those that better meet the above criteria. Interestingly no US sector ETFs came up in that list, which mostly includes European and Asian ETFs. This coincides with recent analysis pointing to a weakening of the US Market relative to the International markets. So if you are looking to extend your profits in the short to medium term then checking this list is not a bad idea at all.