Dominate the Stock Market

Quick User’s Manual

Copyright: Panos Panagiotou,

Panagiotou LTD, United Kingdom

Introduction

In financial markets for every buy there is a sell and for every investor that makes a profit someone else must record a loss. So, who stands on the winning and who on the losing side?

When it comes to professional investors and according to a S&P Dow Jones Indices scorecard published on March 2015 “86% of active large-cap fund managers failed to beat their benchmarks in the last year (2014) … and 82% did the same over the last decade”.

Regarding individual investors and according to a study published by Harvard’s School of Finance and entitled «Can Individual Investors Beat the Market?», about 20 percent of the investors studied were able to beat the market consistently while the top 10 percent of investors studied earned about 38 percent above the market average per year.

In search of what distinguishes the winning 20% of individual investors from the losing 80% of them, David Hirshleifer, co-author of the above mentioned study and professor of finance at Ohio State University’s Fisher College of Business, found an answer. Investors from the winning group are “very sophisticated” and have “superior skills” and investors from the losing group not only aren’t sophisticated or skilled but can be foolish too. In his own words: “Our findings are consistent with the hypothesis that there is a wide range of individual investors, from the foolish traders to the very sophisticated … It seems some investors do have superior skills that allow them to profit more than most”.

Cambridge Dictionary defines the word “sophisticated” as “intelligent or made in a complicated way and therefore able to do complicated tasks” and the word “skill” as “an ability to do an activity or job well, especially because you have practiced it”. It also defies the word “foolish” as “unwise or not showing good judgment”.

In his 1999 study entitled «Human behavior and the efficiency of the financial system» Nobel Laureate economist and Professor at Yale University Robert Shiller shed some light on what David Fisher calls “foolish” investment behavior. According to Shiller investors do not trade based on sophisticated tools neither do they form analytical skills but, driven by greed and fear, overconfidence, over- and under reaction, gambling behavior and speculation, perceived irrelevance of history, magical and quasi-magical thinking and mislead by extremes of emotion, subjective thinking and the whims of the crowd, consistently form irrational expectation for the future performance of securities, the economy and financial markets.

In a 2011 study entitled «The Behavior of Individual Investors» and conducted by Brad Barber, Professor at Graduate School of Management of University of California, Davis and Terrance Odean, Professor at Haas School of Business of University of California, Berkley, the authors pinpoint some other “foolish” behavior of individual investors’ such as selling winning investments while holding losing ones (the “disposition effect”), engage in naïve reinforcement learning by repeating past behaviors that coincided with pleasure while avoiding past behaviors that generated pain, getting influenced by where they live and work and tend to hold stocks of companies close to where they live and invest heavily in the stock of their employer etch.

In the effort to secure a position in the group of the 20% of investors that consistently win in the financial markets, it is critical to avoid the above mentioned features and mistakes of the group of the 80% of investors that consistently lose and replace them by concrete and well-crafted analytical and trading skills and by the use of sophisticated stock analysis tools.

According to Investopedia, ‘stock analysis is a term that refers to the evaluation of a particular trading instrument, an investment sector or the market as a whole … and there are two basic types of stock analysis: fundamental analysis and technical analysis. Fundamental analysis concentrates on data from sources including financial records, economic reports, company assets and market share. Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a security’s intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity.”

According to Wikipedia, data analysis is “a process of inspecting, transforming and modeling data with the goal of discovering useful information, suggesting conclusions, and supporting decision-making”.

As security prices and volume is financial data and since “process” and “method” are synonyms, after combining the two definitions we conclude that financial technical analysis is “a process of evaluating securities by inspecting, transforming and modeling financial data (price and volume) with the use of statistics and with the goal of discovering useful information, identifying patterns that can suggest future activity and supporting decision-making”.

So does financial technical analysis work? Well, this is like asking if any form of data analysis work and the apparent answer is the better done the greater the chances to produce satisfying results. As a thorough analysis of your business might not reveal every possible opportunity or warn you about all potential risks but will definitely pinpoint the most probable and obvious ones, a thorough financial technical analysis should guide you through the most obvious market opportunities and risks. If it fails to do so then it either wasn’t thorough enough or you didn’t try your best to appreciate and apply it adequately.

And this is where DomiStock, a fully Personalized Stock Analysis Robo System, fits in. It empowers self-directed investors with innovative technology that helps building and managing personalized investment strategies to dominate the financial markets. To better help investors DomiStock provides two editions, the DomiStock Home™ and the DomiStock Pro™ one.

DomiStock Home™ is your best choice if you are a self-directed home trader and you need a quick and efficient technical analysis methodology with easy to use and reliable tools, suitable for all styles of trading, from the most defensive to the most aggressive and for any trading timeframe, from the long term to the intraday one.

DomiStock Pro™ is your best choice if you are a self-directed trader with a professional trader’s needs. This version takes financial technical analysis in the pro level by providing custom forecasting, maximum potential profit – loss calculations, optimal trading strategy analysis, buy – sell and hedging signals, parameter based scans, risk profile and strategy based adjusted scans, risk profile tailored portfolios with auto rebalancing and hedging tools, cross and multi asset screens and tools, risk appetite indicators, auto-drawn support – resistance lines and trend lines, support – resistance auto detection, alerts of extreme demand / supply points – inflated / deflated price levels, and much more.

With unique design, capabilities and utility, DomiStock, is ideal for individual investors with long, medium, short or intraday investment horizon and of any knowledge and experience level.

DomiStock in academic research and projects

Financial Technical Analysis Robo-Advisor of Choice, Columbia University, Behavioral Finance Project

“Robo-Advisors and Individual Investors”

DomiStock was the Technical Analysis Software of choice in the Behavioral Finance international research project entitled “Robo-Advisors and Individual Investors conducted in fall 2015 at Columbia University (Master of Science in Financial Engineering, Department of Industrial Engineering and Operations Research, Columbia University).

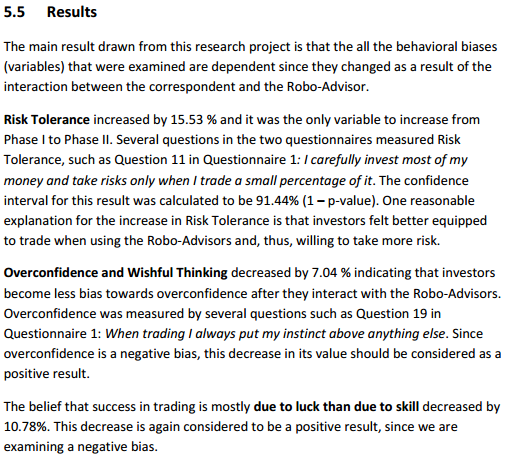

DomiStock was found to have significantly helped traders to overcome their negative behavioral biases. The “Conclusion” on the final report of the project reads: “This research study showed that behavioral biases were influenced by the interaction of the investors with Robo-Advisors. Specifically, six out of the seven behavioral biases that were examined decreased significantly. Overconfidence & Wishful Thinking, Quasi-magical Thinking and Luck/Skill were slightly decreased, while Gambling Behavior, Home Bias and Disposition Effect were largely decreased. This is a very positive result showing that biases can be eliminated when investors interact with rational Robo-Advisors. Interestingly, Risk Tolerance was the only bias to increase. This can be attributed to the fact that investors felt more “safe” to take risk when having advanced software to advise them. This study also showed that apart from the change in behavioral biases the overall decision-making process of investors was affected by the Robo-Advisors”.

Financial Technical Analysis Software of Choice, Columbia University Investment Project

“Global Asset Allocation Fund”

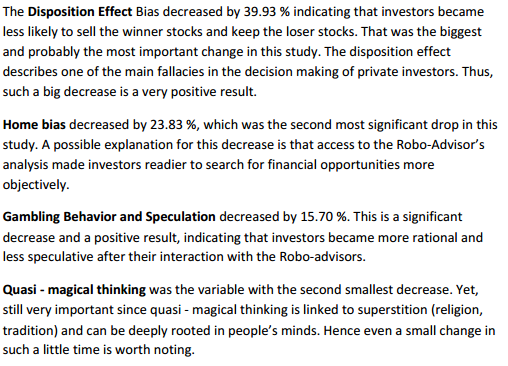

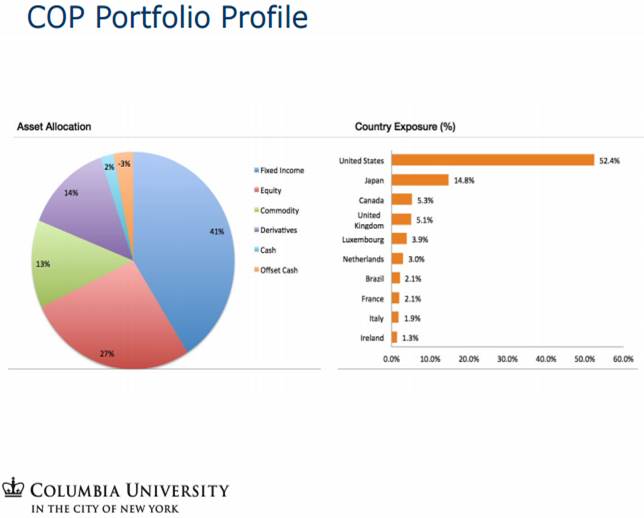

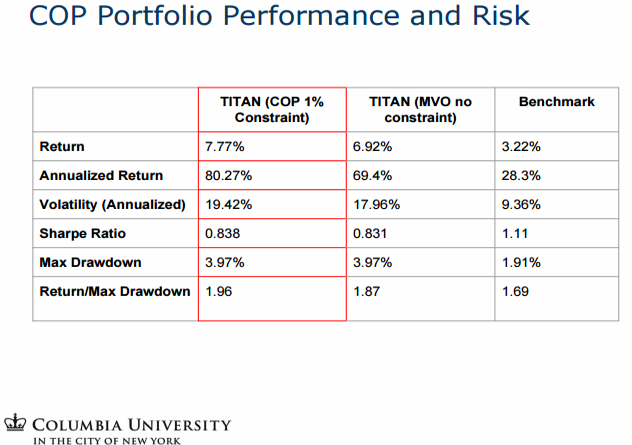

DomiStock was the Technical Analysis Software of choice in the investment project entitled “Global Macro Multi-Asset Investment Fund”, that involved the creation and management of a multi-asset fund, conducted in spring 2016 at Columbia University (Master of Science in Financial Engineering, Department of Industrial Engineering and Operations Research, Columbia University). Two portfolios where constructed and tested with simulated trading and recorded annualized profits of 69,4% and 80,27% respectively.

Record Winning Innovative Formulae

DomiStock uses a series of record winning formulae that, when tested on historical data, have outperformed any FOREX pair and any benchmark equities or commodities index in the world, including the Benchmark Indices or their US listed SPDRs (ETFs) for: US, EU,China, Japan, Germany, UK, France, India, Italy, Brazil, Canada, Russia, Australia, Spain, Mexico, Malaysia, Netherlands, Switzerland, Turkey, Saudi Arabia, Argentina, Sweden, Nigeria, Poland, Norway, Austria, Egypt, South Africa, Israel, Denmark, Singapore, Ireland, Portugal, Greece, Sweden, Taiwan, South Korea,, Hong Kong, Belgium and many others.

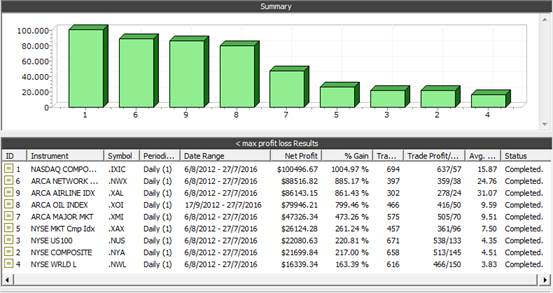

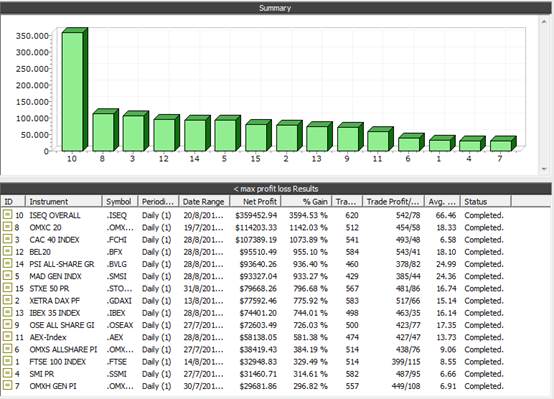

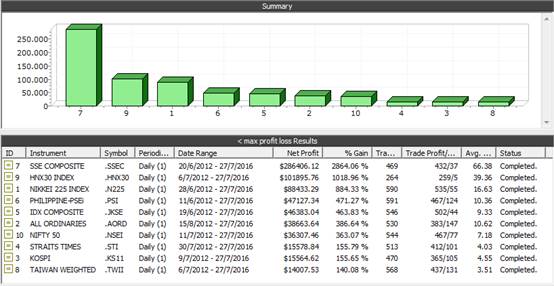

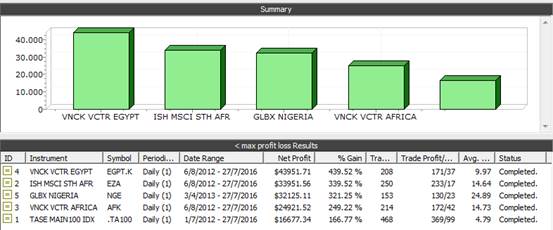

In Appendix 1 and 2 you can find the MetaStock System Tester Simulation Screenshots from tests with daily and intraday data on:

- American Indices

- European Indices

- Asia/Pacific Indices

- Africa/Middle East Indices (& ETFs)

- International Indices SPDRS (ETFs)

- FOREX Pairs

- The Dow Jones Constituents

DomiStock was the outperformer in each and every simulation.

Meet

Dominate the Stock Market from Home

DomiStock Home™ is your best choice if you are a self-directed home trader and you need a quick and efficient technical analysis methodology with easy to use and reliable tools, suitable for all styles of trading, from the most defensive to the most aggressive and for any trading timeframe, from the long term to the intraday one.

Basic Theoretical Concepts

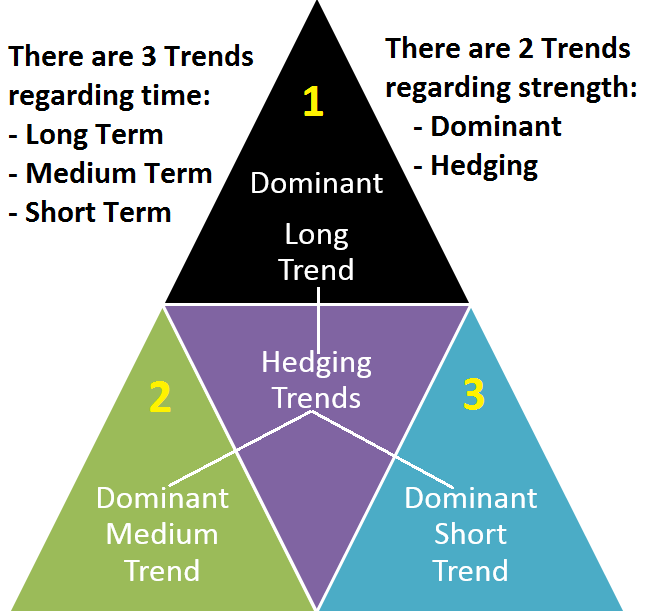

Trend

What is a ‘Trend’

In financial technical analysis a “Trend” is the general direction of a market or of an asset as reflected in their price movement. A trend can be:

1) Up, Down or Sideways (direction)

2) Short – a few days -, Medium – a few weeks – Long – a few months – (length)

Very short trends are called Intraweek or Intraday ones and very long trends are called price cycles, or bull & bear cycles.

3) Strong or Weak (strength)

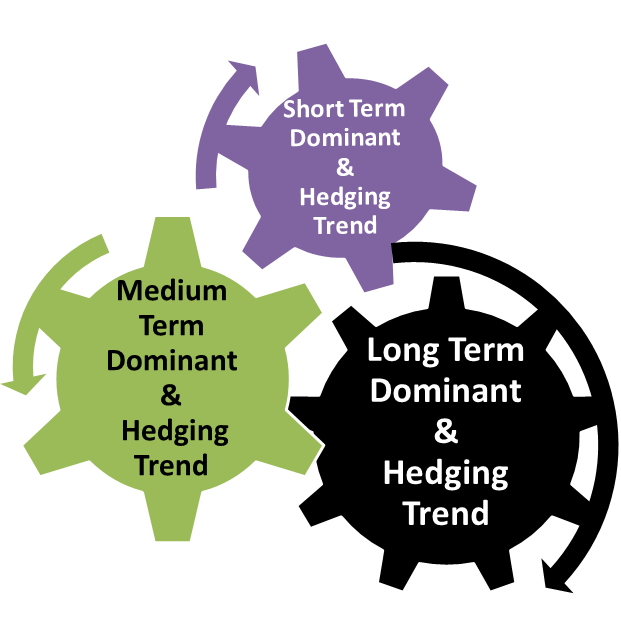

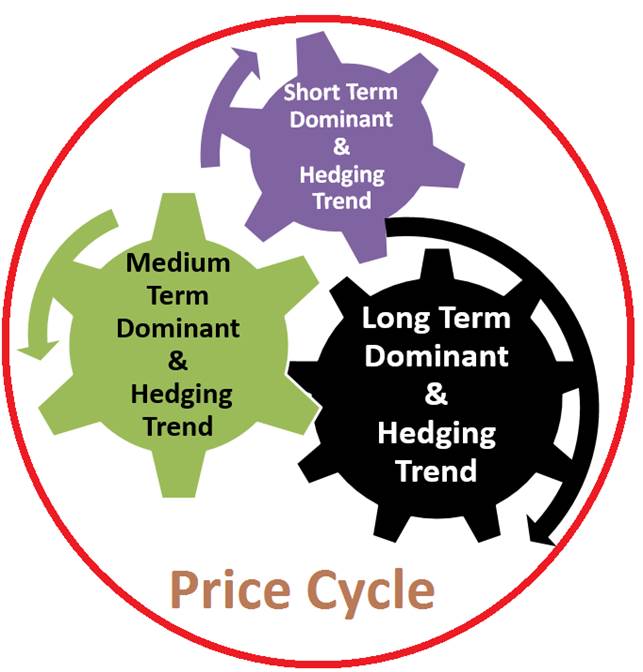

Interconection of Trends

All trends are interconnected. Even if a trader looks to take advantage of a short trend, medium and long trends will have a significant effect on her / him. And vice versa, a trader who is mainly interested in long term trends, might be affected by medium or short term movements. Hence, regardless a trader’s profile, she / he should learn to respect all trends and gain a good understanding of the way they interconnect.

Any specific trend would be most connected to two trends, the immediately smaller and the immediately bigger one. Hence:

- intraweek trends woud be most linked to intraday (immediately smaller) and short term (immediately bigger) trends

- short term trends woud be most linked to intraweek and medium term ones

- medium term trends would be most linked to short term and long term ones

- long term trends woulb most linked to mediun term ones and to price cycles

DomiStock Home – Basic Features

Dual Band Trading System™

It is composed of dual, independent, cooperating, auto – adjustable in volatility, time and chart periodicity, bands, one of shorter and one of longer time span. It enhances the direct comparison of the shorter and longer price trends, giving the trader freedom to analyze and trade one, two or multiple trends simultaneously. It supports minute to monthly bar charts auto – adjustment and requires no user intervention.

HighLow Trading System™

It is composed of 1) a band derived from the highs and lows of an assets price, 2) the Price Position Indicator, 3) the Medium, Short & Very Short Term Performance Lines, 4) the Max Profit – Loss Calculator, 5) the Automated Support – Resistance Lines and Trendlines, and 6) the Extreme Demand / Supply – Inflated & Deflated Price Alerts. The basic and secondary up & down signals are produced from the interaction of the assets price with the first three mentioned indicators and of the interaction of all indicators and tools between them.

Auto-Drawn Support – Resistance Lines & Trendlines

In financial technical analysis, support is the price level after a decline at which demand is strong enough to prevent a security’s price from declining further. During a correction in an upward long term trend, as the price declines towards support (recent trough) and gets cheaper, buyers become more inclined to buy and sellers become less inclined to sell. By the time the price reaches the support level, chances are that demand will overcome supply and prevent the price from breaching the support.

On the other hand, during a long term upward trend resistance levels will be breached more often than not, as the overall demand surpasses the overall supply and the security reaches new highs (not necessarily historical ones). The exact opposite logic applies during long term downward trends, where resistance levels tend to remain intact and support levels to eventually be broken.

A support or resistance trend line is a line segment that connects two troughs or peaks and then extends into the future to act as a moving support or resistance.

DomiStock automatically plots all important support and resistance levels and support and resistance trend lines on any chart – intraday, daily, weekly, monthly.

Nearest Support – Resistance Levels Auto Detect

At any given time, there might be several important support and resistance levels but only two can be the closer to the security’s price. Those two levels are crucial for entry and exit signals and stop loss orders. DomiStock draws on chart these two, nearest to the security’s price, support and resistance levels, to better assist the trader to recognize and take advantage of them. The nearer support – resistance levels are drawn on daily, intraday, weekly and monthly charts.

Maximum Profit / Loss Calculator – Resultant Direction

An estimation of the potential profit or loss you may obtain from trading a specific security over a period of time can be a valuable information. The Max Profit / Loss Calculator calculates, in percentage points, the probable maximum profit and loss of the security under consideration over a chosen period (up to 250 periods). In addition, it calculates, in percentage points, the resultant direction of the maximum supply and demand forces applied on the security.

As a rule of thumb, when a trade is favorable then the value of the maximum potential profit (green line) is positive and greater than the absolute value of the maximum potential loss (red line). In this case, the resultant direction (two bars that fluctuate above and below zero) returns a positive value. The further above zero the resultant direction is the greater the chances for a trade in the specific horizon to be profitable. The Max Profit Loss Calculator helps to both estimate the potential profit or loss you may obtain from trading a specific security over a period of time and works equally well as a risk calculator and a price forecaster.

Extreme Demand / Supply – Inflated & Deflated Price Alerts

DomiStock automatically recognizes extreme supply / demand points or potentially inflated / deflated prices and rates them from 3, for the most extreme from the supply side or the most potentially inflated, to -3, for the most extreme from the demand side or the most potentially deflated. These alerts are drawn above and below the price bars.

Price Position Indicator (PPI)

The Price Position Indicator shows where the current closing price of an asset is positioned in relation to its price range over a period of time Thus, a value of 100% for a 50 period time range, indicates that the asset’s current price is positioned at the highest point of the security’s 50 period price range.

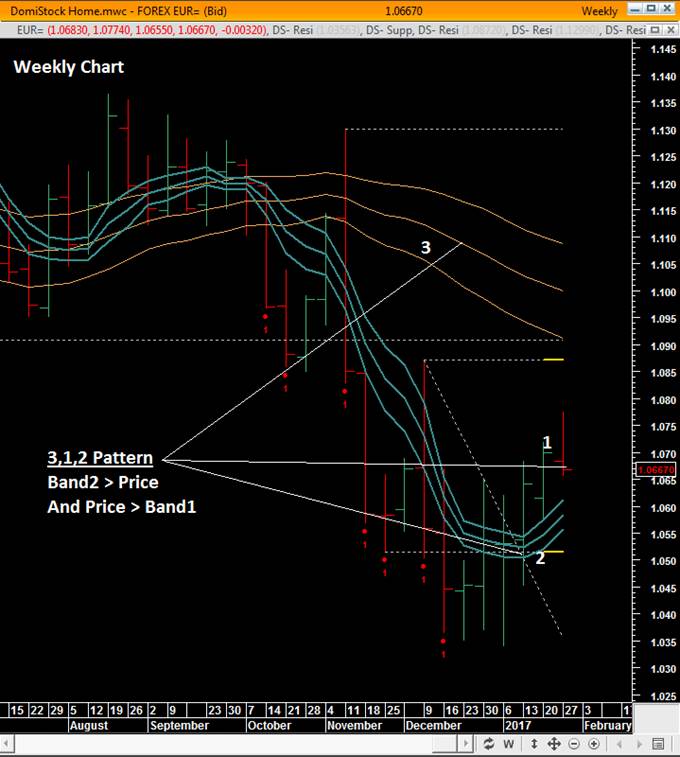

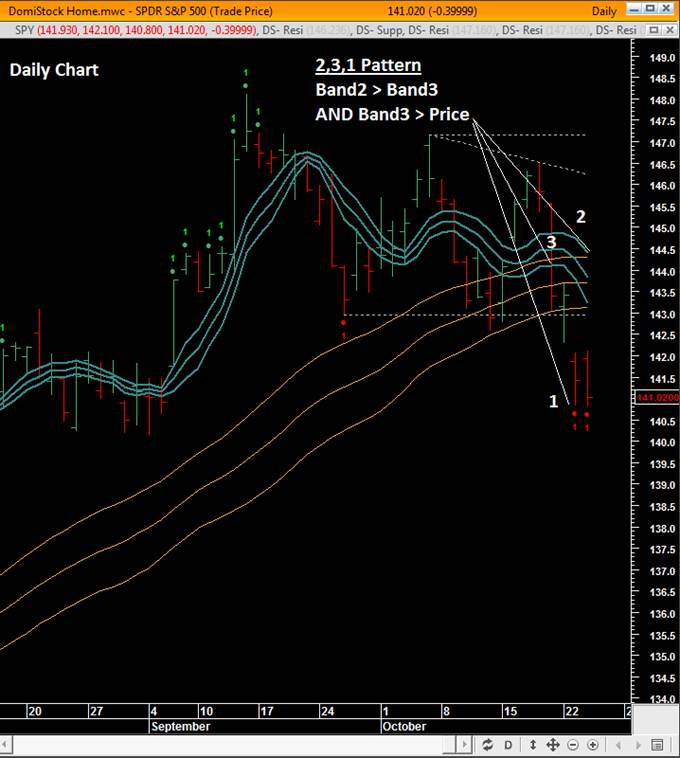

Dual Band Trading System™

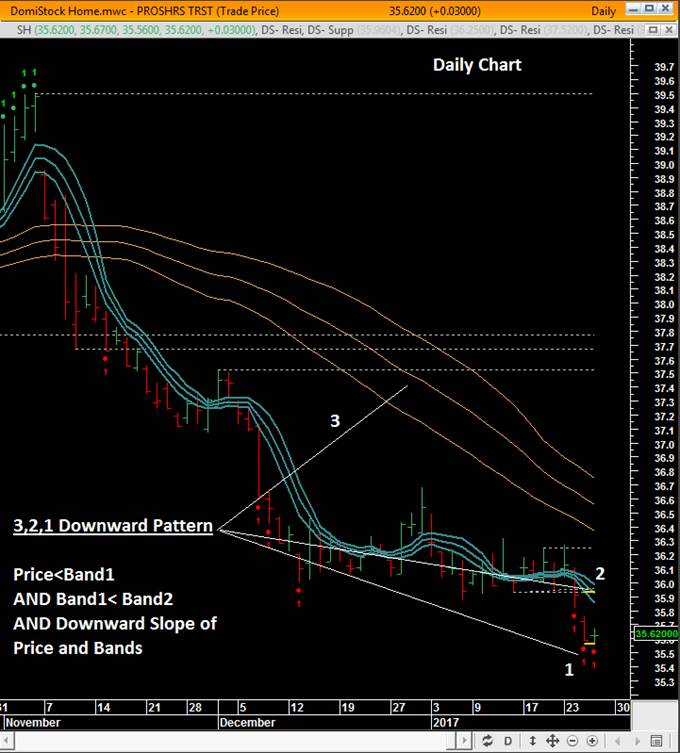

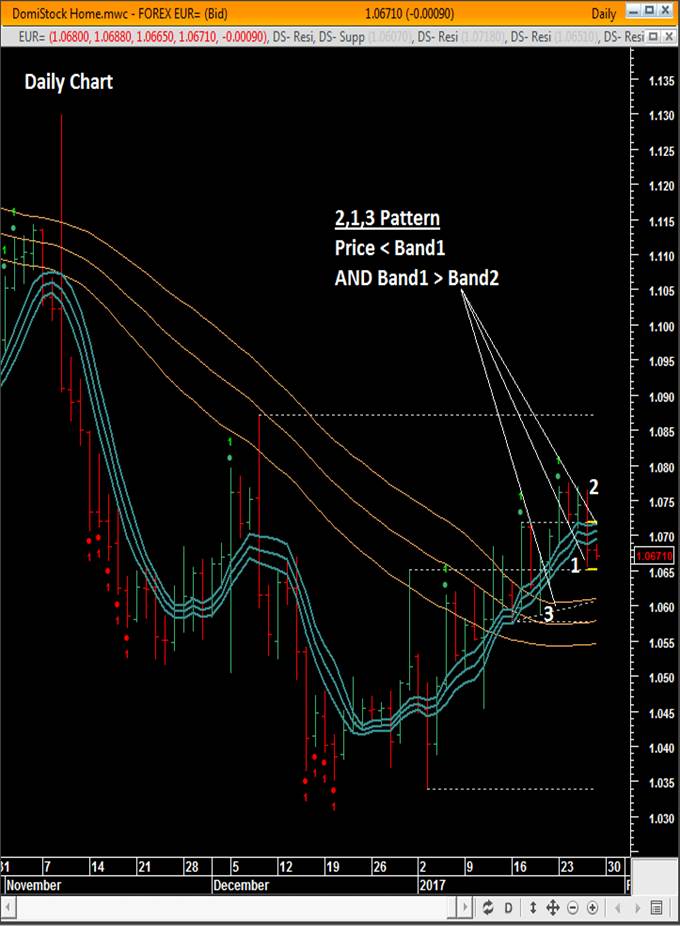

1, 2, 3 – 3,2,1 Chart Patterns™

The interaction between the asset price and the bands of the Dual Band Trading System result to specific chart pattern combinations that can help to identify trends and make calculated forecasts of future price movements. Out of the 8 basic chart patterns, 4 are especially important. The first one of them is the 1,2,3 pattern. For this to be formed the security’s price (1) must be above the shorter in length band (2) and that one must be above the longer in length band (3). This pattern is even stronger when the security’s price and both bands are in an upward slope (1,2,3 Up pattern). DomiStock’s Home expert, automatically identifies all 8 basic chart patterns.

1, 2, 3 – 3,2,1 Chart Patterns™ – Basic Combinations & Interpretation

Chart Pattern | Interpretation | Risk |

| 1,2,3 Up | Very Bullish | Price inflation |

| 1,2,3 | Bullish | Momentum loss |

| 1,3,2 | Bullish – Neutral | B2, B3 cross up failure |

| 2,1,3 | Neutral | B2, B3 cross down |

| 2,3,1 | Neutral | B2, B3 cross down |

| 3,2,1 Down | Very Bearish | Price deflation |

| 3,2,1 | Bearish | Momentum gain |

| 3,1,2 | Bearish – Neutral | B2, B3 cross up failure |

Price Position Indicator | Interpretation | Target |

| > 80 Rising | Very Bullish | 100, (Inflation risk) |

| > 80 Falling | Bullish – Neutral | 100 |

| >50<80 Rising | Bullish | 80 |

| >50 <80 Falling | Neutral | 50 |

| <20 Falling | Very Bearish | 0, (Deflation risk) |

| <20 Rising | Bearish – Neutral | 20 |

| >20<50 Falling | Bearish | Momentum gain |

| >20<50 Rising | Neutral | 50 |

Dual Band Trading System™: Template

1,2,3 Upward Chart Pattern™

3,2,1 Chart Pattern™ & 1,2,3 Chart Pattern™

3,2,1 Downward Chart Pattern™

2,1,3 Chart Pattern™

3,1,2 Chart Pattern™

1,3,2 Chart Pattern™

2,3,1 Chart Pattern™

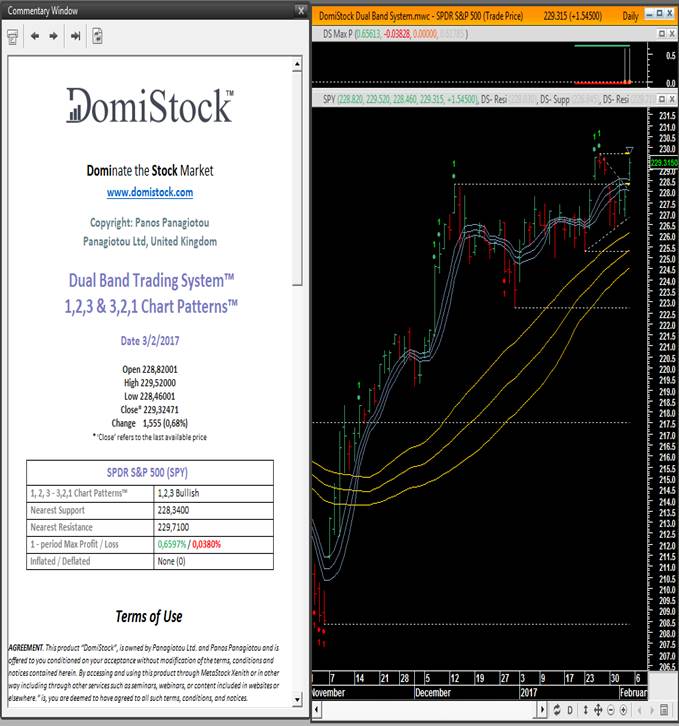

Dual Band Trading System™: Expert Commentary

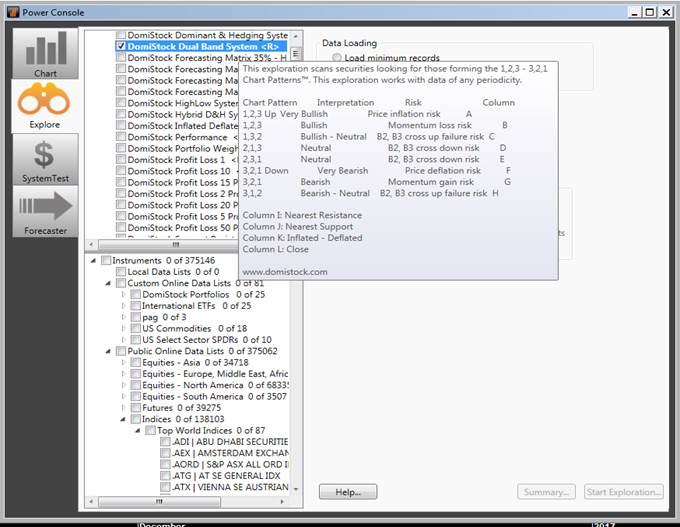

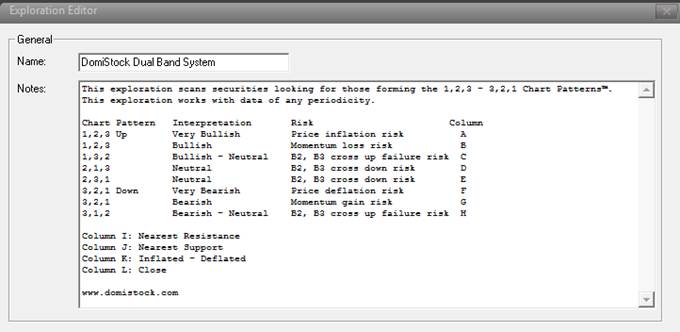

Dual Band Trading System™: Exploration

This exploration scans securities looking for those forming the 1,2,3 – 3,2,1 Chart Patterns™. This exploration works with data of any periodicity.

The Zoom In – Zoom Out Trading Technique™

Some traders like to zoom in into a chart and look for immediate profits by making decisions without previous planning, while others like to zoom out so they can place price movements in context and exploit larger trends.

Zooming in can reveal opportunities and threats by enlarging them in the making and it can help in identifying new developments and recognizing competing theories that are better able to explain them. Trading focused only on the short term without a wider perspective or a long-term rationale is risky and can prove hazardous. For example, those same emerging risks that zoom in traders can recognize first, might be more threatening to them. Additionally, zooming in can obscure the big picture, leading traders to overlook important trends and expose themselves to unnecessary risks.

Zooming out helps traders see the general direction of a market / asset, put price movements in context and not miss big trends, which can be very profitable. But traders focused only on the long term might not recognize emerging opportunities or risks that might even affect the big picture and cost them money.

Room to Zoom

To get a complete picture, traders should make room to zoom. The best traders can zoom in to examine smaller trends, take advantage of emerging opportunities and respond to developing risks and zoom out to evaluate the importance and validity of a trend, to spot the general direction and benefit best from both small and big trends. The best investors don’t divide their trades into situational or strategic and emotional or contextual, neither do they choose between short term or long term trading but they embrace the concept that all trends are interconnected and that it’s better to trade across a continuum of trends, by zooming in and out when needed.

DomiStock’s Home template can be used with any kind of data, intraday, daily, weekly or monthly, as it automatically adjusts its tools to the timeframe chosen and this attribute makes it ideal when applying the Zoom in & Zoom Out Trading Technique™.

By zooming out into a chart, by using, for example, monthly data, it becomes easier to see the big picture and to recognize and analyze the established long term trend. By zooming in into it, by using, for example, daily data, it becomes easier to recognize, analyze and trade the current and ongoing trend, having first position it in the bigger picture.

Now, by turning to hourly data it becomes easier to anticipate and predict a signal that will eventually be given on the daily chart too, but in a later stage.

That is because for a trend to be established on a daily chart, it has to first become established on an hourly chart, and for that to happen it has to be established on a 30-minute chart, etch.

By adopting and mastering the Zoom in & Zoom Out Trading Technique™ a trader will only become better and will enjoy more her / his trading.

HighLow Trading System™

It is composed of

1) A band derived from the highs and lows of an assets price

2) The Price Position Indicator

3) The Medium, Short & Very Short Term Performance Lines

4) The Max Profit – Loss Calculator

5) The Automated Support – Resistance Lines and Trendlines

6) The Extreme Demand / Supply – Inflated & Deflated Price Alerts.

The HighLow Bands are time adjusted. The longer the periods chosen the wider the bands and the slowest the crosses. DomiStock’s default period is “1” and the periodicity range is 1-3.

The HighLow Trading System™ is ideal for the Zoom In – Zoom Out Trading Technique™.

The basic and secondary up & down signals are produced from the interaction of the assets price with the first three mentioned indicators. Decision making is enhanced by the interaction between all indicators and tools used.

| Main Up Signals | Secondary Up Signals | Up Momentum Loss |

| PPI CrossUp 20, CrossUp HB | PPI CrossUp 20 | CrossDn HB |

| PPI CrossUp 50, CrossUp HB | PPI >=80, CrossUp LB | VST Perf<0 |

| Perf>0, CrossUp LB | ||

| CrossUp HB | ||

| PPI CrossUp 80 | ||

| Main Down Signals | Secondary Down Signals | Dn Momentum Loss |

| PPI CrossDn 80, CrossDn LB | PPI CrossDn 80 | CrossUp LB |

| PPI CrossDn 50, CrossDn LB | PPI<=20, CrossDn HB | VST Perf>0 |

| Perf<0, CrossDn HB | ||

| CrossDn LB | ||

| PPI CrossDn 20 | ||

| Neutral Signals | ||

| PPI >=80, CrossDn LB | ||

| PPI <=20, CrossUp HB | ||

HighLow Trading System™: Template

HighLow Trading System™: Expert

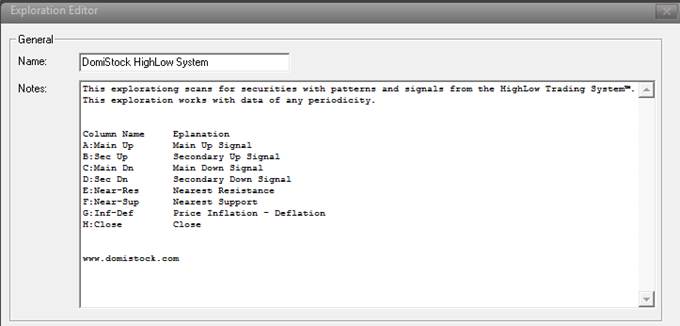

HighLow Trading System™: Exploration

Meet

Dominate the Stock Market like a Pro

DomiStock Pro™ is your best choice if you are a self-directed trader with a professional trader’s needs. This version takes financial technical analysis in the pro level by providing custom forecasting, maximum potential profit – loss calculations, optimal trading strategy analysis, buy – sell and hedging signals, parameter based scans, risk profile and strategy based adjusted scans, risk profile tailored portfolios with auto rebalancing and hedging tools, cross and multi asset screens and tools, risk appetite indicators, auto-drawn support – resistance lines and trend lines, support – resistance auto detection, alerts of extreme demand / supply points – inflated / deflated price levels, and much more.

Basic Theoretical Concepts of DomiStock Pro

Categories of Trends

Duration of Trend

Long term trend can last for several months

Medium term trend can last for several weeks

Short term trend can last for several days

Smaller trends as intraweek or intraday can last for several hours

All Trends Are Interconnected

Price Cycles Include all Trends

Major price cycles can last for several quarters or even years and include all trends. They can be positive, negative or neutral.

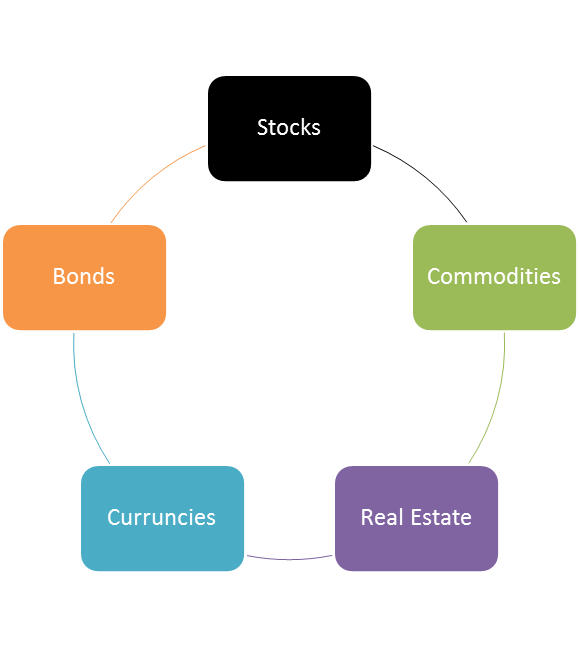

Financial Markets Are Interconnected

DomiStock Pro – Basic Features

Auto-Drawn Support – Resistance Lines & Trendlines

In financial technical analysis, support is the price level after a decline at which demand is strong enough to prevent a security’s price from declining further. During a correction in an upward long term trend, as the price declines towards support (recent trough) and gets cheaper, buyers become more inclined to buy and sellers become less inclined to sell. By the time the price reaches the support level, chances are that demand will overcome supply and prevent the price from breaching the support.

On the other hand, during a long term upward trend resistance levels will be breached more often than not, as the overall demand surpasses the overall supply and the security reaches new highs (not necessarily historical ones). The exact opposite logic applies during long term downward trends, where resistance levels tend to remain intact and support levels to eventually be broken.

A support or resistance trend line is a line segment that connects two troughs or peaks and then extends into the future to act as a moving support or resistance.

DomiStock automatically plots all important support and resistance levels and support and resistance trend lines on any chart – intraday, daily, weekly, monthly.

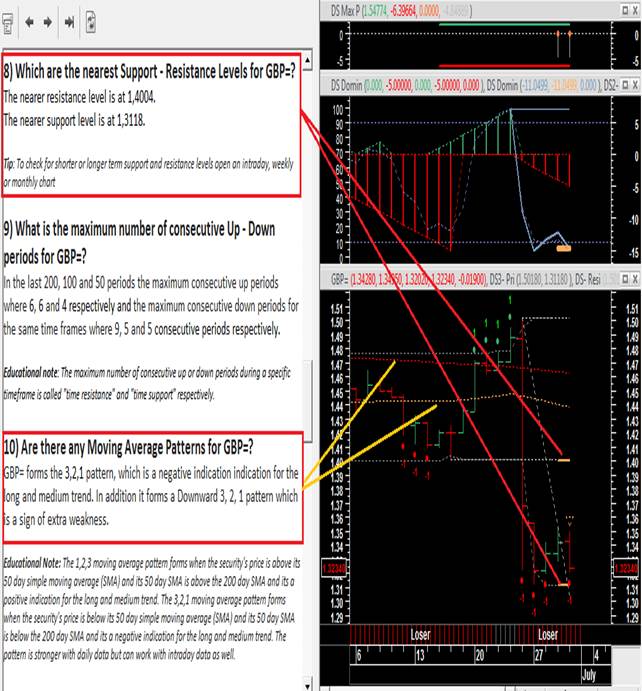

Nearest Support – Resistance Levels Auto Detect

At any given time, there might be several important support and resistance levels but only two can be the closer to the security’s price. Those two levels are crucial for entry and exit signals and stop loss orders. DomiStock draws on chart these two, nearest to the security’s price, support and resistance levels, to better assist the trader to recognize and take advantage of them. The nearer support – resistance levels are drawn on daily, intraday, weekly and monthly charts.

Maximum Profit / Loss Calculator – Resultant Direction

An estimation of the potential profit or loss you may obtain from trading a specific security over a period of time can be a valuable information. The Max Profit / Loss Calculator calculates, in percentage points, the probable maximum profit and loss of the security under consideration over a chosen period (up to 250 periods). In addition, it calculates, in percentage points, the resultant direction of the maximum supply and demand forces applied on the security.

As a rule of thumb, when a trade is favorable then the value of the maximum potential profit (green line) is positive and greater than the absolute value of the maximum potential loss (red line). In this case, the resultant direction (two bars that fluctuate above and below zero) returns a positive value. The further above zero the resultant direction is the greater the chances for a trade in the specific horizon to be profitable. The Max Profit Loss Calculator helps to both estimate the potential profit or loss you may obtain from trading a specific security over a period of time and works equally well as a risk calculator and a price forecaster.

Extreme Demand / Supply – Inflated & Deflated Price Alerts

DomiStock automatically recognizes extreme supply / demand or potentially inflated / deflated prices and rates them from 3, for the most inflated, to -3, for the most deflated. These alerts are drawn above and below the price bars.

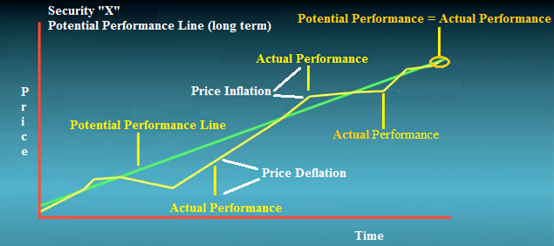

The theory behind the Inflated – Deflated Levels

A 95 degrees Fahrenheit (35 degrees Celsius) temperature during a Las Vegas summer is pretty close to the potential temperature of the city and wouldn’t cause any worry but the exact same temperature during an Alaska summer would be extremely above the potential one and would be a great reason for worrying. In the same way, a long term performance of a stock market or a security of, for example, 35%, might be quite close to their potential one under their specific economic and financial conditions and hence might cause no significant price inflation and thus no worry but the exact same performance of another stock market or security (or even of the same ones under different conditions) could be quite extreme and lead to dangerous price inflation (the opposite would apply to a 35% drop that could lead or not to significant price deflation) hence to great worry.

In any case, either of an upward, downward or sideways cycle, supply and demand forces can push the actual performance and price of a security far away from its’ potential ones, to reach extreme and potentially unstable inflationary or deflationary levels.

The Inflated – Deflated Levels alerts of DomiStock inform the trader that the market’s “temperature” is unusually high or low.

Following the direction of the long term trend while hedging any short term corrections and taking advantage of the Inflationary and Deflationary Gaps is a strategy that raises the probability of success.

Forecasting Matrix

Charting the Resultant Direction of 3 or 4 different Max Profit – Loss Calculator periods, constructs a forecasting matrix that provides the probable future path of the security of interest in percentage points. In the following example the forecasting matrix foresees a breakout in the Dow Jones Index the short term (1-5 periods) and a flattening of the price curve in the intermediate term (15-50 periods).

These calculations can be customized with respect to time horizon, probabilities range, and recent data significance.

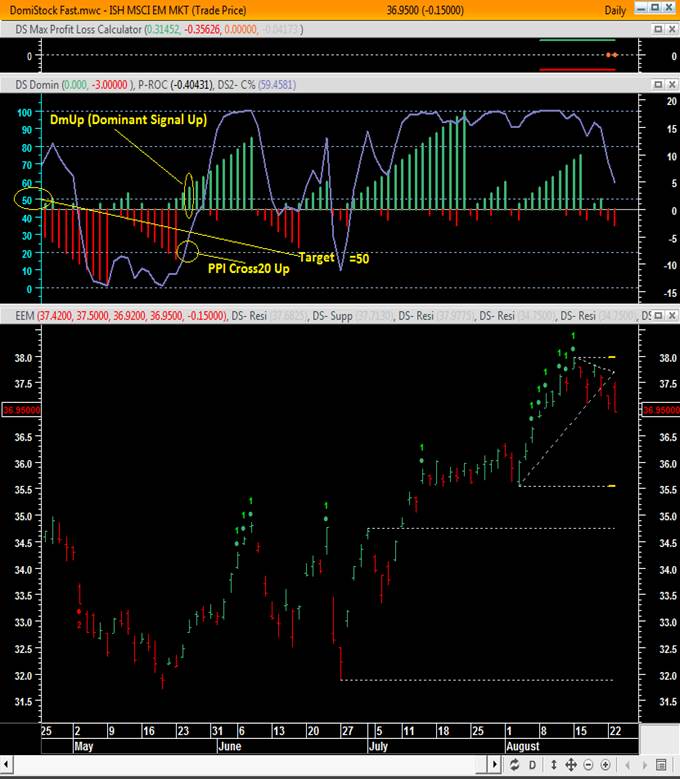

Dominant & Hedging Trading System™

Timing & Dominant Trend: Good timing is important in every business and any kind of decision, let it be about an investment one or not. When it comes to the financial markets, timing is even more critical because of the special conditions applied to them, like their fast speed, their volatility, their complexity and the risk involved. Timing is all about the synchronization of the trader with the market (or the current security of interest). For that to happen, the trader must recognize and if possible anticipate the Dominant trend in all basic timeframes and mainly in the timeframe of special interest. The better the timing in following or anticipating the Dominant trend, the greater the chances to maximize profits and minimize losses.

Hedging: According to Cambridge dictionary “hedge is a way of (1) protecting, (2) controlling or (3) limiting something” and when trading we need to protect our investment and our profits, control our positions and limit our risk.

One can be right about the overall trend of the market and still lose money because of bad timing. On the other hand, both the overall trend analysis and timing can be good but the results poor because of the lack of a hedging strategy. Hence a trader needs not only to time the market by following and anticipating the Dominant trend but also to hedge the market by recognizing and anticipating the Hedging (Challenging) trend. Said differently, a trader needs not only to get the Dominant but also the Hedging Trend right.

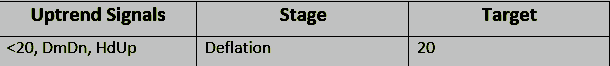

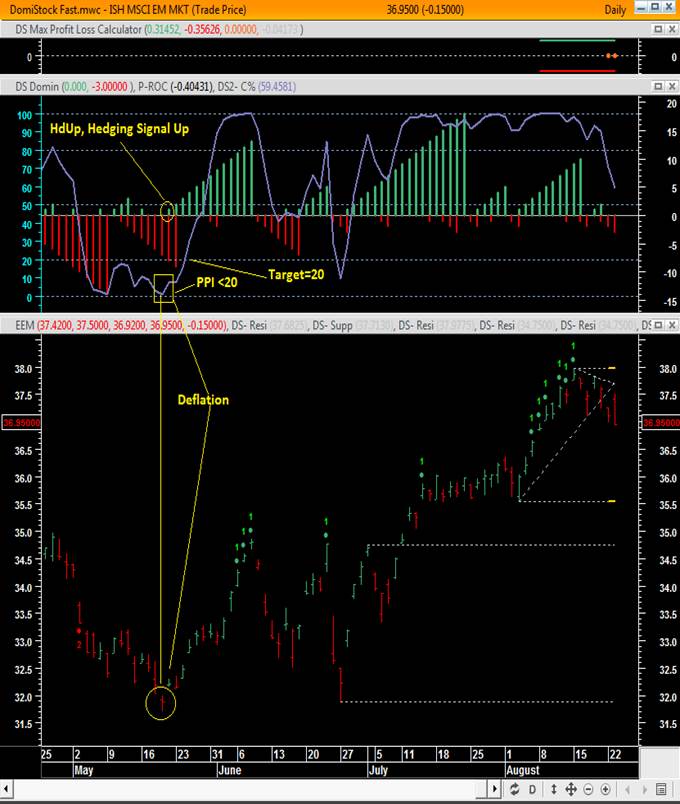

Basic Signals

Example 1

Example 2

Example 3

Example 4

Example 5

Example 6

Example 7

Example 8

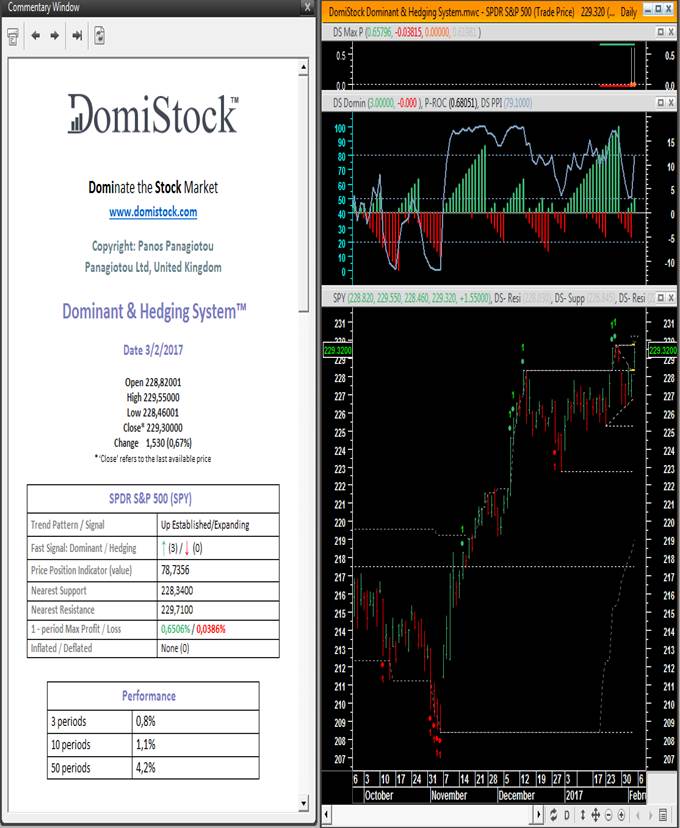

Dominant & Hedging Trading System™: Expert

Dominant & Hedging Trading System™: Exploration

Supply & Demand Theory – Fuzzy Logic and the Dominant & Hedging Signals

From June 27, 2016 till September 21, 2016, DomiStock gave an upward signal for the S&P’s 500 ETF, “SPY”. That was a 60-period “go long” and “hold long” signal, indicating an upward trend for SPY. Although quite strong, SPY’s rise during that period wasn’t a straight line as there were some ups and downs and a few more demand and supply days. DomiStock’ hybrid system captured those down days / periods / trends by producing a downward hedging signal while holding the upward Dominant one.

This unique ability of DomiStock’s, Dominant & Hedging Trading System™ i.e. to provide two simultaneous and of opposite direction signals, is based on the fuzzy (or multivariable) logic behind the system.

Let’s start by defining a “perfect” rally should attract only buyers and no sellers and each day should be higher than the previous one.

In that case we would be able to say that demand for that specific security in would be 100% and supply 0%. But perfect rallies are the exemption to a rule that wants most trends to be “imperfect” and to attract both buyers and sellers and hence both demand and supply. A binary signal producing system would be able to either give an up or down signal. DomiStock overcomes this problem by giving two signals at once while distinguishing them between the Dominant and the Hedging one. This way the trader can keep taking advantage of the Dominant trend while hedging the secondary one.

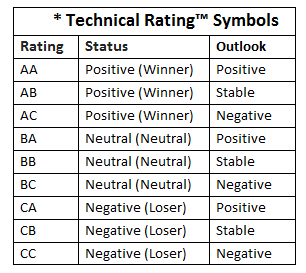

DomiStock’s Technical Rating System™

DomiStock’s Technical Rating System™ is an evaluation of the technical status and outlook of a prospective financial instrument, based on the analysis of its price and volume information, through the use of quantitative, statistical, computational and technical analysis models. This is the first ever rating system of financial securities and products, based on their price and volume action and not on fundamental data.

DomiStock’s Technical Rating System™ symbols and their meaning are as follows:

DomiStock’s Technical Rating System™ template includes the Hybrid Dominant & Hedging Signal System, the PPI indicator, the Max – Profit Loss indicator, the auto-support / resistance lines and trendlines and the extreme / demand – inflationary / deflationary expert symbols.

The Hybrid Dominant & Hedging Signal System is based on an innovative formula that makes it able to provide short, medium and long term signals according to the underlying forces of demand and supply. At the same time, it recognizes all hedging trends, allowing for the trader to hold a position for as long as needed in order to take full advantage of a trend’s potential, while hedging any challenging to the dominant trends in order to maximize profits and minimize losses. The default edition is designed to operate with daily and intraday data.

DomiStock’s Technical Rating System™: Template

DomiStock’s Technical Rating System™: Expert Advisor

The Expert Advisor provides the Technical Rating of the security of choice and a list of the top technical studies a trader needs to beat the markets

Expert Advisor Educational: Top 10 technical questions answered

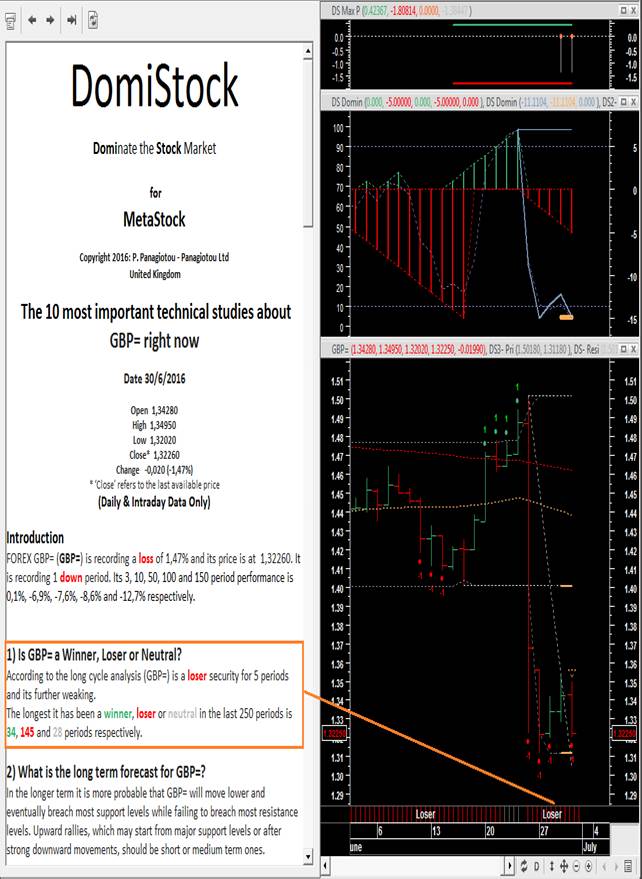

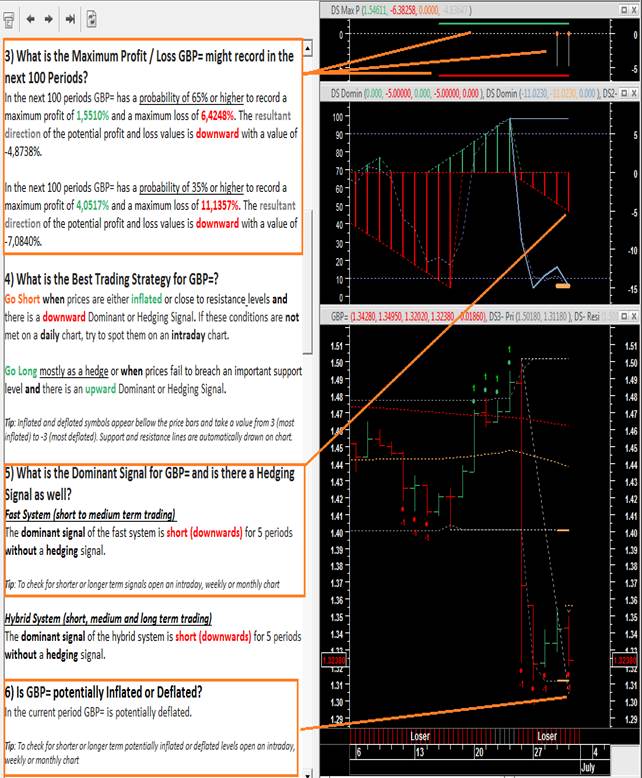

DomiStock Educational Expert Advisor provides, with the click of a button, the answer to the 10 most important technical questions about the security of interest and in specific:

1. What is the Technical Rating of the security and is it a Winner, Loser or Neutral?

2. What is the long term forecast?

3. What is the Maximum Profit / Loss it might record in the next 100 Periods?

4. What is the Best Trading Strategy?

5. What is the Dominant Signal for the security and is there a Hedging Signal as well?

6. Is the security potentially Inflated or Deflated?

7. What is the Maximum Profit / Loss it might record in the current (1) period?

8. Which are the recent Time Support – Resistance Levels?

9. What is the maximum number of consecutive Up – Down periods for the security?

10. Are there any Moving Average Patterns?

Let’s see an example of the DomiStock Expert for the British pound / US dollar exchange rate

Expert Advisor Educational

Winner, Neutral, Loser Security Template

According to DomiStock’s theory, a winner security is more probable to move higher and eventually breach most resistance levels while holding most support levels. A loser security is more probable to move lower and eventually breach most support levels while failing to breach most resistance levels. A neutral security is more probable to move sideways or trendless and eventually fail to breach major resistance levels while holding major support levels. A winner security’s rating would be A, a loser’s C and a neutral’s B. In that sense the “Winner, Neutral, Loser” security evaluation derives from the rating system.

DomiStock’s Technical Rating System™: Trading Strategies

DomiStock’s Technical Rating System™ interacts with the Hybrid Dominant & Hedging Signal System and the extreme / demand – inflationary / deflationary expert symbols to provide automated trading strategies. The strategies are easy to use through the DomiStock Trading Strategies exploration

1) Long the “Deflated Winner” – Short the “Inflated Loser”

The DomiStock “Basic Strategy” is of low to medium risk and looks to: long securities that

1) Are Winners

2) Are Deflated

3) Are close to support levels

4) Have given a positive Dominant or at least positive Hedging Signal

And to short securities that:

1) Are Losers

2) Are Inflated

3) Are testing resistance

4) Have given a negative Dominant or at least negative Hedging Signal

2) Long the Deflated Neutral– Short the Inflated Neutral

This DomiStock strategy is of medium to high risk and looks to: long securities that

1) Are neutrals

2) Are deflated

3) Are testing / holding important support levels

4) Have given a positive Dominant or Hedging Signal

And to short securities that:

1) Are neutrals

2) Are inflated

3) Are testing / failing important resistance levels

4) Have given a negative Dominant or Hedging Signal

3) Climb the Trend

The DomiStock “Climb the Trend” strategy is of medium to high risk and looks to: long securities that

1) Are winners or neutral

2) Have given a positive Dominant or at least positive Hedging Signal

3) Are not inflated

4) Are not testing resistance

And to short securities that:

1) Are losers or neutral

2) Have given a negative Dominant or at least negative Hedging Signal

3) Are not deflated

4) Are not testing support

4) Contrarian: Long the Loser – Short the Winner

The DomiStock “Long the Loser – Short the Winner” strategy is of medium to high risk and looks to long securities that:

1) Are current losers

2) Are recent winners

3) Are deflated

4) Are testing support

5) Have given a positive Dominant or Hedging signal

The DomiStock Trading the Winner Strategy allows the shorting of securities that:

1) Are current winners

2) Are recent losers

3) Are inflated

4) Are testing resistance

5) Have given a negative Dominant or Hedging Signal

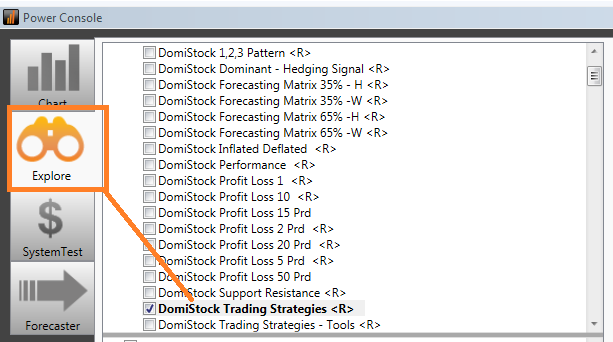

4) Risk Profile & Strategy Based Adjusted Scans

In order to apply DomiStock Trading Strategies to your analysis and trading all you need is to follow the next 2 steps:

1. Run the DomiStock Trading Strategies Exploration on the securities of your choice

2. Use the DomiStock Fast or DomiStock Dual Template to open the securities that meet DomiStock’ s Strategies criteria

Step 1

Run the DomiStock Trading Strategies Exploration on the securities of your choice

Step 2

Use any of DomiStock’s Templates to open the securities that meet the criteria of DomiStock’s Strategies. +

+

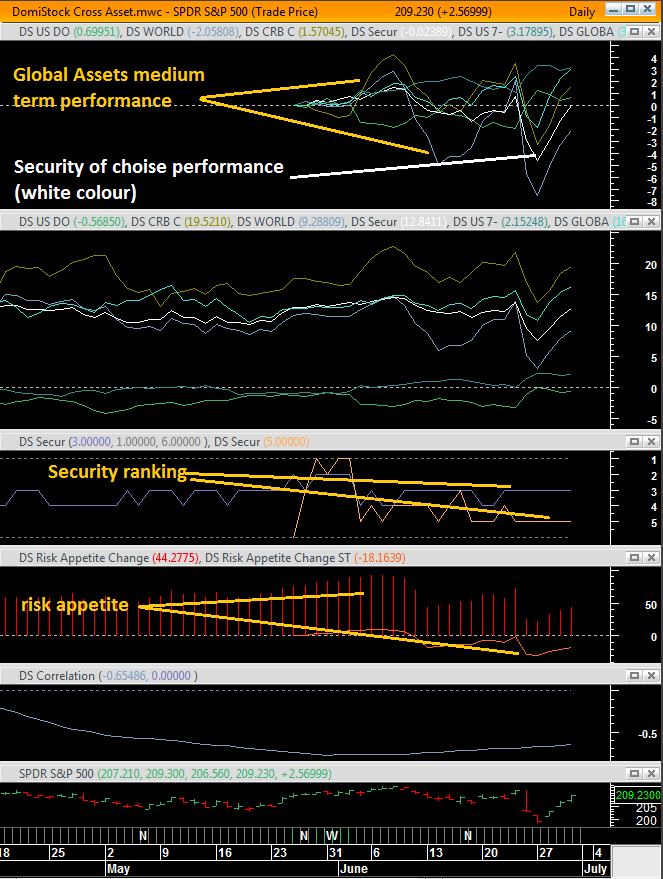

DomiStock – Cross Asset Screen Features

The DomiStock Cross Asset screen plots the long and medium term (100-day and 25-day) performance of the security of interest in comparison to that of the five major asset benchmark indexes (or their ETFs), i.e.

1. the US Bond Market (represented by the ETF “IEF”, US 7-10 YR Treasury)

2. the World’s Stock Index (represented by the ETF “VEU”)

3. the US Dollar Index

4. the Commodities Index

5. the Global Real Estate Index (represented by the ETF “RWO”)

This comparative and global look helps the trader which assets dominate investors interest and also helps to compare how the security of interest performs relative to the major asset benchmark indexes. (US Data Package needed).

Cross Asset Security Ranking Indicator

The Cross Asset Security Ranking Indicator ranks the security of choice from a scale of 1 to 6 on the base of its performance relative to the five major asset benchmark indexes.

An absolute relative winner security would rank no1 in both the long and medium term.

Global Risk Appetite Indicator

The Risk Appetite Change Indicator is very useful for the trader as it calculates the long and short term change in the risk appetite of investors. A positive risk appetite is favorable for assets like stocks whilst a negative risk appetite is favorable for assets like bonds.

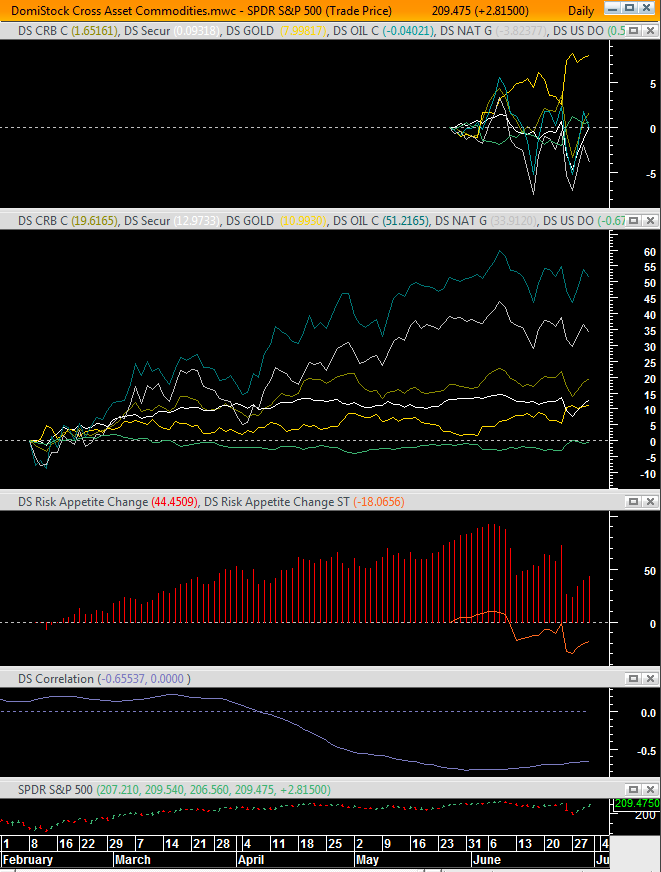

Other DomiStock Cross Asset Screens

DomiStock provides cross asset screens for:

- Global Stocks

- Global Bonds

- Commodities

- Major Currencies

- Global Real Estate Stocks

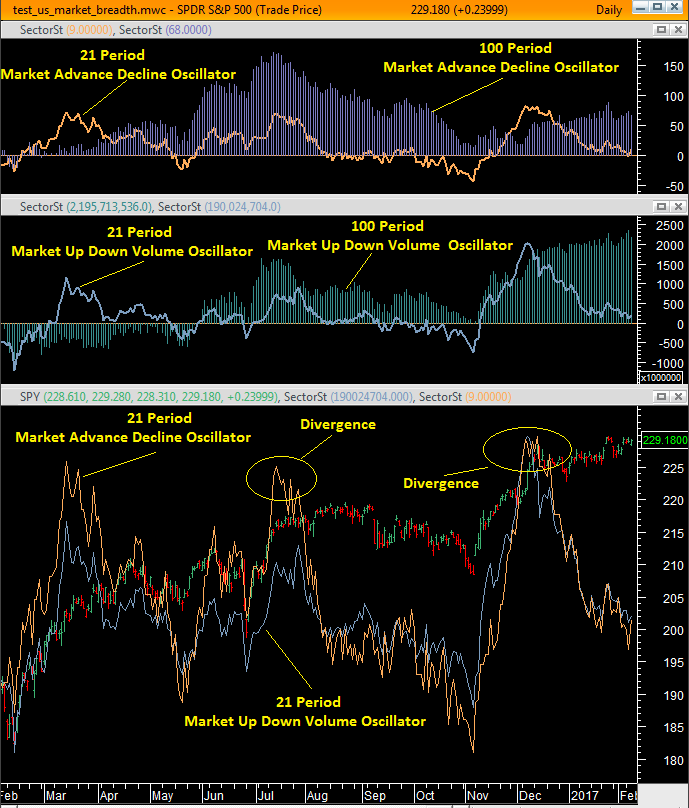

- US Sectors

Finally, DomiStock provides a US Market Breadth Screen, with volume and correlation studies tools.

DomiStock Cross Asset

DomiStock Cross Asset – Stocks

DomiStock Cross Asset – Bonds

DomiStock Cross Asset – Commodities

DomiStock Cross Asset – Currencies

DomiStock Cross Asset – Real Estate

DomiStock US Sectors

DomiStock – US Market Breadth

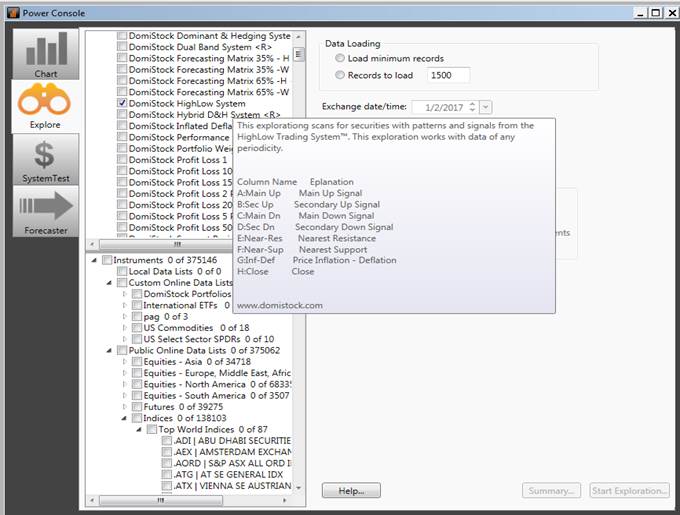

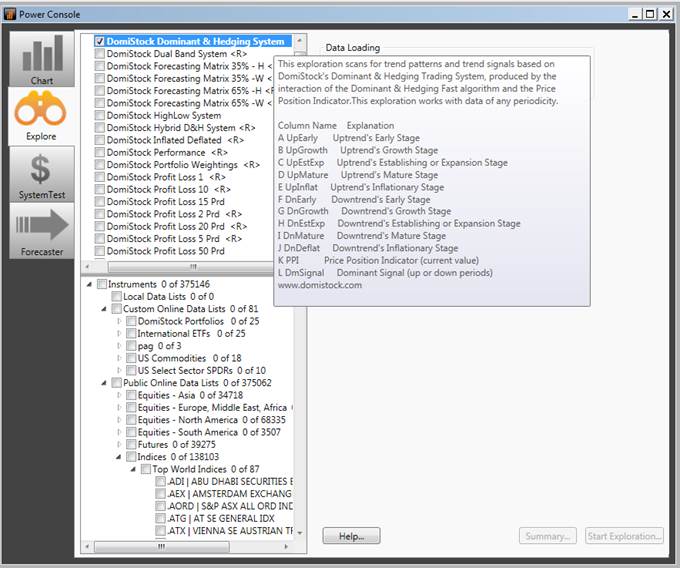

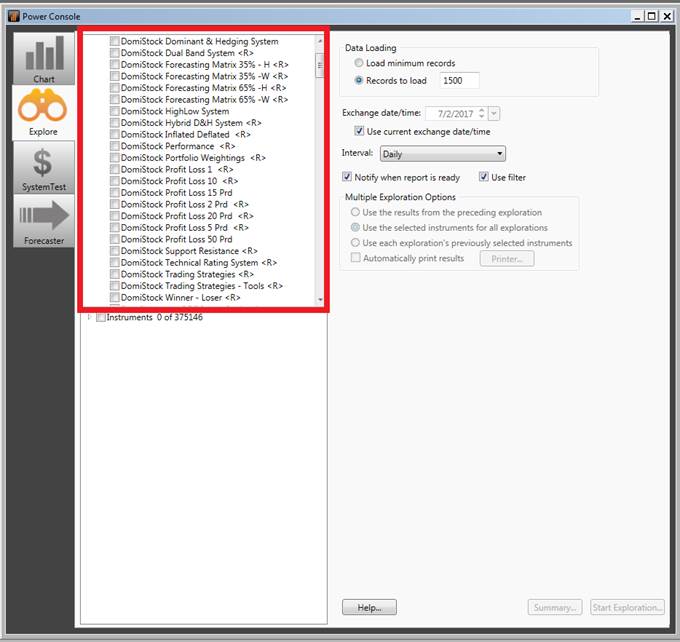

23 DomiStock Explorations / Scans

DomiStock offers 23 explorations to best help the user spot trading opportunities and to apply the DomiStock Strategy. The explorations cover all offered tools and can be used with intraday or daily data.

DomiStock Dominant & Hedging System

This exploration scans for trend patterns and trend signals based on DomiStock’s Dominant & Hedging Trading System, produced by the interaction of the Dominant & Hedging Fast algorithm and the Price Position Indicator. This exploration works with data of any periodicity.

DomiStock Dual Band System

This exploration scans securities looking for those forming the 1,2,3 – 3,2,1 Chart Patterns™. This exploration works with data of any periodicity.

DomiStock Forecasting Matrix 35% – H

This scan forecasts the 35% probability Resultant Direction of 11 different Max Profit – Loss Calculator periods, constructing a forecasting matrix that provides the probable future path of the security of interest in percentage points. The scan also checks if the security is Winner, Loser or Neutral (Col L).The scan uses the “High Recent Data Significance” option.

DomiStock Forecasting Matrix 35% -W

This scan forecasts the 35% probability Resultant Direction of 11 different Max Profit – Loss Calculator periods, constructing a forecasting matrix that provides the probable future path of the security of interest in percentage points. The scan also checks if the security is Winner, Loser or Neutral (Col L).The scan uses the “Weighted Data Significance” option.

DomiStock Forecasting Matrix 65% -H

This scan forecasts the 35% probability Resultant Direction of 11 different Max Profit – Loss Calculator periods, constructing a forecasting matrix that provides the probable future path of the security of interest in percentage points. The scan also checks if the security is Winner, Loser or Neutral (Col L). The scan uses the “High Recent Data Significance” option.

DomiStock Forecasting Matrix 65% -W

This scan forecasts the 35% probability Resultant Direction of 11 different Max Profit – Loss Calculator periods, constructing a forecasting matrix that provides the probable future path of the security of interest in percentage points. The scan also checks if the security is Winner, Loser or Neutral (Col L). The scan uses the “Weighted Recent Data Significance” option.

DomiStock HighLow System

The DomiStock Hybrid Dominant & Hedging exploration is part of the DomiStock Rating System and its Winner – Loser – Neutral version. It scans securities looking for those with dominant or hedging – up or down signals, from either the Hybrid D&H algorithm or the D&H Fast algorithm. This exploration needs at least 300 periods of data to work properly so it’s better to use Daily or Intraday data.

DomiStock Hybrid D&H System

The DomiStock Hybrid Dominant & Hedging exploration is part of the DomiStock Rating System and its Winner – Loser – Neutral version. It scans securities looking for those with dominant or hedging – up or down signals, from either the Hybrid D&H algorithm or the D&H Fast algorithm. This exploration needs at least 300 periods of data to work properly so it’s better to use Daily or Intraday data.

DomiStock Inflated Deflated

DomiStock Inflated – Deflated Prices exploration scans for securities whose price is inflated or deflated (column A) and which are winners, losers or neutral (column C) and returns the score points (with 3 being the highest inflated and -3 the highest deflated) of inflation or deflation (column A). If the price is neither inflated or deflated then the scan returns a 0 value (column A). This exploration works with Daily or Intraday data.

DomiStock Performance

DomiStock Performance exploration filters securities according to their performance in the last 100, 30, 10 and 3 periods. The exploration also scans for securities whose price is inflated or deflated (column E) and which are winners, losers or neutral (column F) and returns the score points (with 3 being the highest inflated and -3 the highest deflated) of inflation or deflation (column E). If the price is neither inflated or deflated then the scan returns a 0 value (column A). This exploration works with Daily or Intraday data.

DomiStock Portfolio Weightings

This exploration returns the maximum weight and the maximum hedge a security included in a portfolio may have. The exploration is also used to scan the securities that consist the various DomiStock Portfolios.

DomiStock Profit Loss 1

DomiStock Profit Loss Calculator-1Day exploration calculates the 1 period expected maximum profit and loss percentage points of the securities scanned, with a probability of either <35% (Col A, B and C respectively) or >65% (Col D, E and F respectively). Columns E and F return the resultant direction of the maximum profit and loss values. This exploration works with Daily or Intraday data.

DomiStock Profit Loss 10

DomiStock Profit Loss Calculator 15 Days exploration, calculates the 10 period expected maximum profit and loss percentage points of the securities scanned, with a probability of either <35% (Col A, B and C respectively) or >=65% (Col D, E and F respectively). Columns E and F return the resultant direction of the maximum profit and loss values. This exploration works with Daily or Intraday data.

DomiStock Profit Loss 15 Prd

DomiStock Profit Loss Calculator 15 Days exploration, calculates the 15 period expected maximum profit and loss percentage points of the securities scanned, with a probability of either <35% (Col A, B and C respectively) or >=65% (Col D, E and F respectively). Columns E and F return the resultant force of the maximum profit and loss values. This exploration works with Daily or Intraday data.

DomiStock Profit Loss 2 Prd

DomiStock Profit Loss Calculator-1Day exploration calculates the 1 period expected maximum profit and loss percentage points of the securities scanned, with a probability of either <35% (Col A, B and C respectively) or >65% (Col D, E and F respectively). Columns E and F return the resultant direction of the maximum profit and loss values. This exploration works with Daily or Intraday data.

DomiStock Profit Loss 20 Prd

DomiStock Profit Loss Calculator 20 Days exploration, calculates the 15 period expected maximum profit and loss percentage points of the securities scanned, with a probability of either <35% (Col A, B and C respectively) or >=65% (Col D, E and F respectively). Columns E and F return the resultant force of the maximum profit and loss values. This exploration works with Daily or Intraday data.

DomiStock Profit Loss 5 Prd

DomiStock Profit Loss Calculator 5 Days exploration, calculates the 5 period expected maximum profit and loss percentage points of the securities scanned, with a probability of either <35% (Col A, B and C respectively) or >=65% (Col D, E and F respectively). Columns E and F return the resultant direction of the maximum profit and loss values. This exploration works with Daily or Intraday data.

DomiStock Profit Loss 50 Prd

DomiStock Profit Loss Calculator 20 Days exploration, calculates the 15 period expected maximum profit and loss percentage points of the securities scanned, with a probability of either <35% (Col A, B and C respectively) or >=65% (Col D, E and F respectively). Columns E and F return the resultant force of the maximum profit and loss values. This exploration works with Daily or Intraday data.

DomiStock Support Resistance

This exploration scans for securities that have just breached support or resistance levels (Col A, 1= Resistance breach, -1=Support Breach, 0=no breach). It also scans for the most important nearest resistance (Col B) and support (Col D) levels and calculates in percentage points the distance the security’s price and the nearest resistance and support levels(Col C and Col E respectively). The scan then checks for inflated or deflated levels (Col F – Inflated=1, Deflated=-1, Neither=0). Finally, columns G to K c return the Resultant Direction of 5 different Max Profit – Loss Calculator periods (1,5,10,20 and 50 respectively), constructing a forecasting matrix that provides the probable future path of the security of interest in percentage points.

DomiStock Technical Rating System

This exploration shorts securities based on their DomiStock Technical Ratings. DomiStock’s Technical Rating System™ is an evaluation of the mid – long term technical status and outlook of a prospective financial instrument. This exploration needs at least 300 periods of data to work properly so it’s better to use Daily or Intraday data.

DomiStock Trading Strategies

This exploration scans securities to find those that meet one of DomiStock’s Strategies criteria. If all criteria of a trading strategy are met the scan returns a value of 100%. On the other hand, if no criteria of a trading strategy are met the scan returns a value of 0%. In any other case the scan returns a value between 0 and 100%.

DomiStock Trading Strategies – Tools

This scan uses the DomiStock’s Strategies tools to check if the security is a Winner, Loser or Neutral (Col B), if it’s a recent Winner or a recent Loser (col H and I), if it is inflated or deflated (Col. C), where the nearest resistance and support levels are (Col D & E) and the signals of the “Dominant & Hedging Signal System – Fast” (Col F and G). Col A returns the close. This expert works with Daily and Intraday data. This scan can be used together with the DomiStock Trading Strategies one.

DomiStock Winner – Loser

DomiStock Winner – Loser exploration scans for securities that are long term Winners (col A), Losers (Col B) or neither i.e. Neutral (col C) and returns the number of periods each of the above is true. This exploration works with Daily or Intraday data.

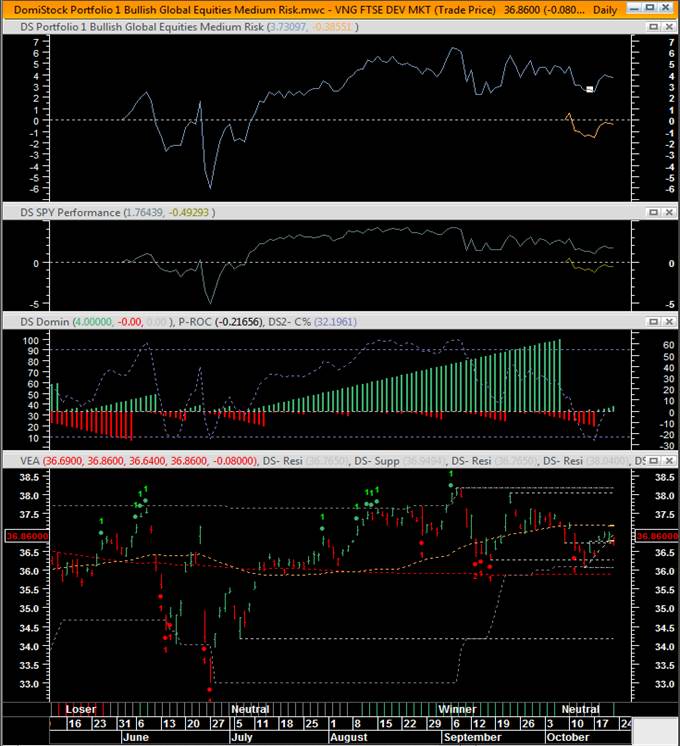

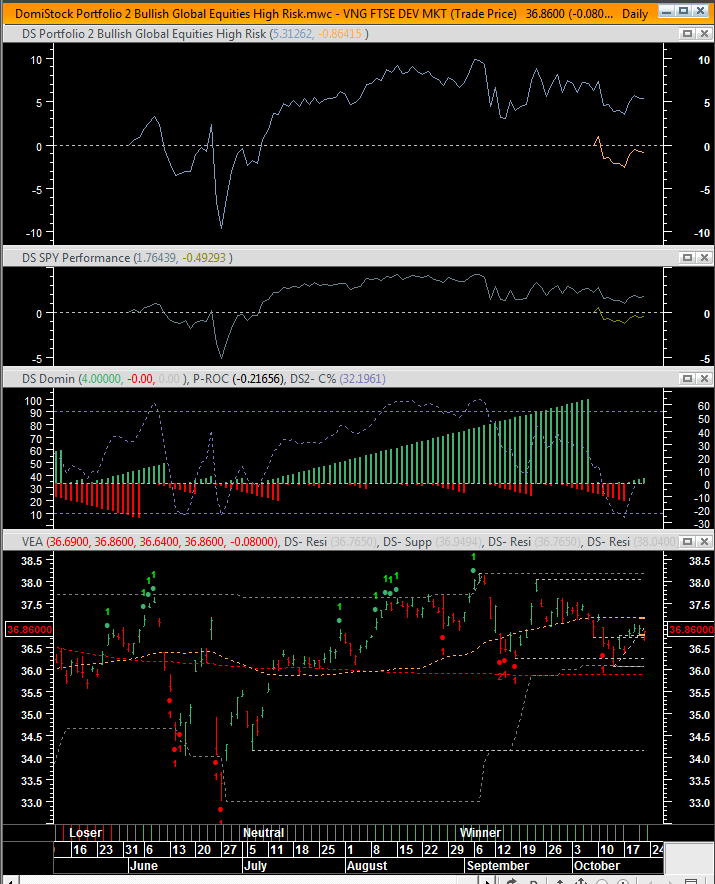

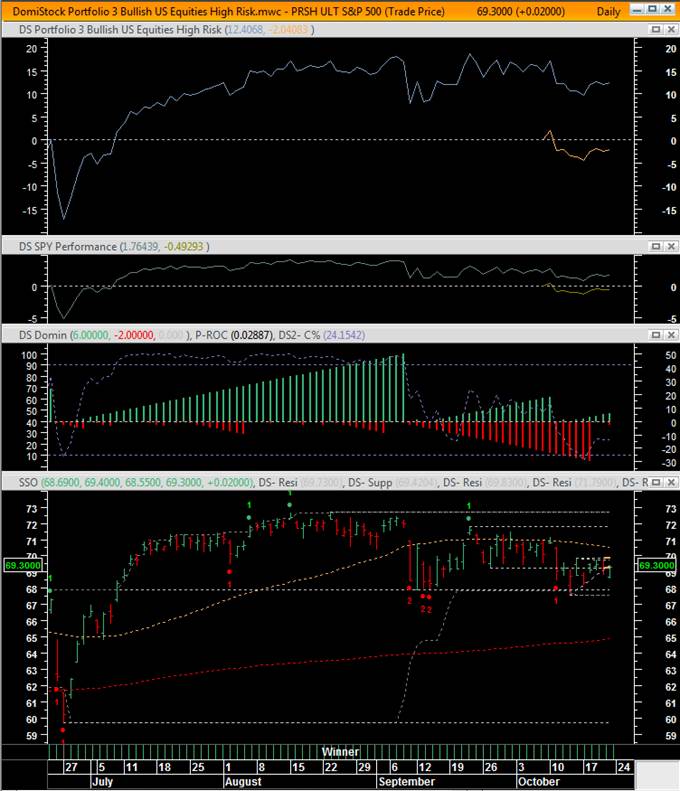

10 Hybrid Robo- Human Optimized Portfolios

DomiStock offers 10 portfolios with rebalancing and hedging tools, that cover both bull and bear markets for equities and commodities. Most portfolios consist of 4 assets where the last one works as a hedge when needed.

The DomiStock Portfolio Weightings Exploration scans the securities that consist the various DomiStock Portfolios and returns the maximum weight each security may have and the maximum hedge that may be taken against potential losses of the portfolio where each security is included in. The final decision on the weighting adjustments for each portfolio is left to the user.

The DomiStock Portfolio Weightings Exploration can also be used to construct different portfolios and to check how exposed or hedged a trader can be on any given asset. (US Data Package needed for the pre-built DomiStock Portfolios).

Portfolio 1: Bullish, Global Equities, Medium Risk

Portfolio 2: Bullish, Global Equities, High Risk

Portfolio 3: Bullish, Global Equities, High Risk

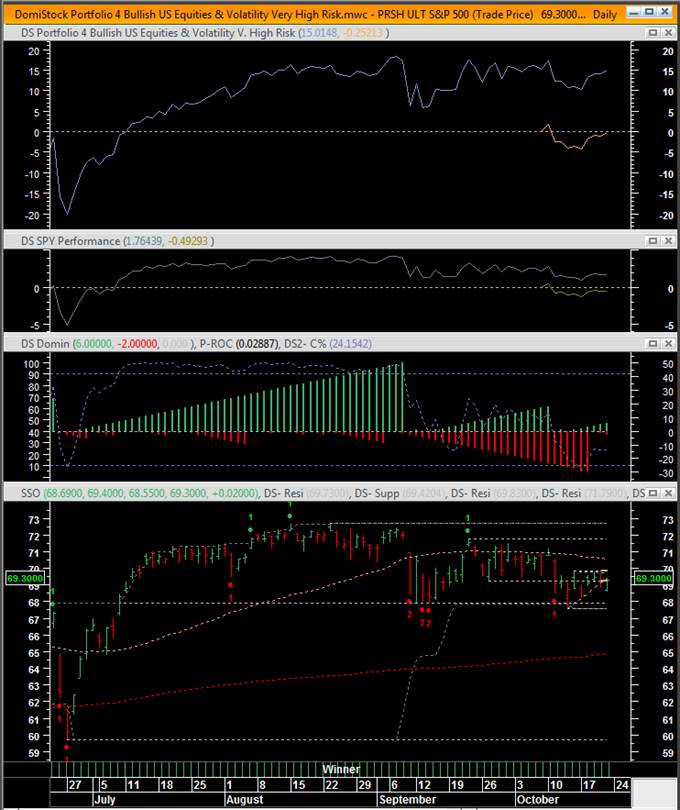

Portfolio 4: Bullish, US Equities & Volatility, Very High Risk

Portfolio 5: Bearish, US Equities, High Risk

Portfolio 6: Bearish, US Equities & Volatility, Very High Risk

Portfolio 7: Bullish, Energy, Very High Risk

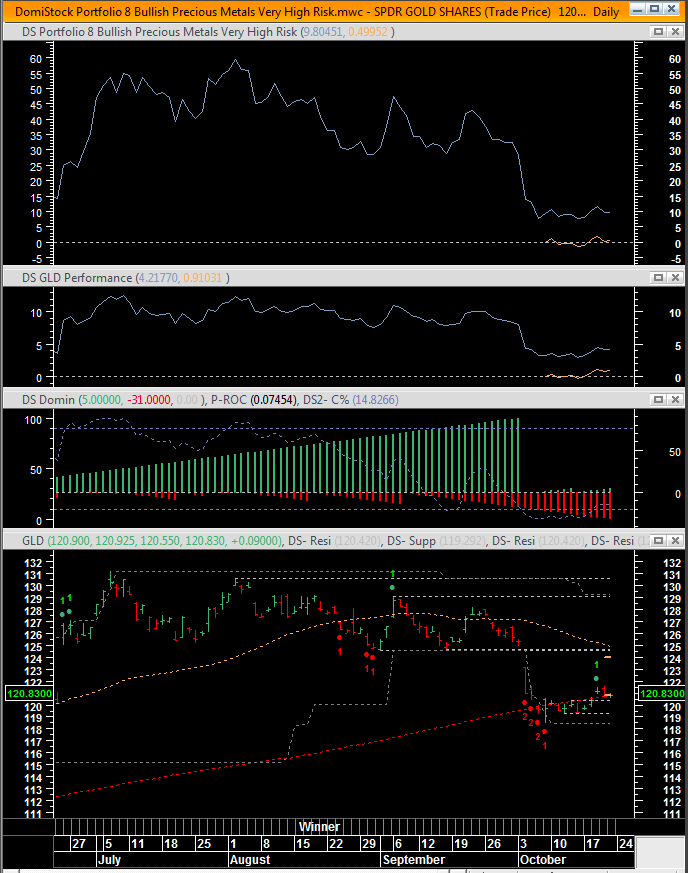

Portfolio 8: Bullish, Precious Metals, Very High Risk

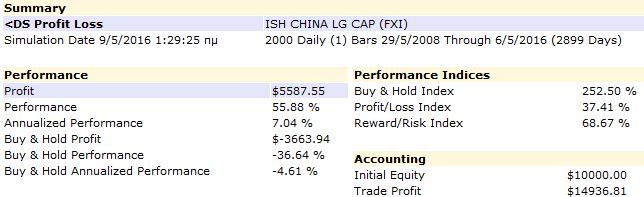

Portfolio 9: Bullish, China, High Risk

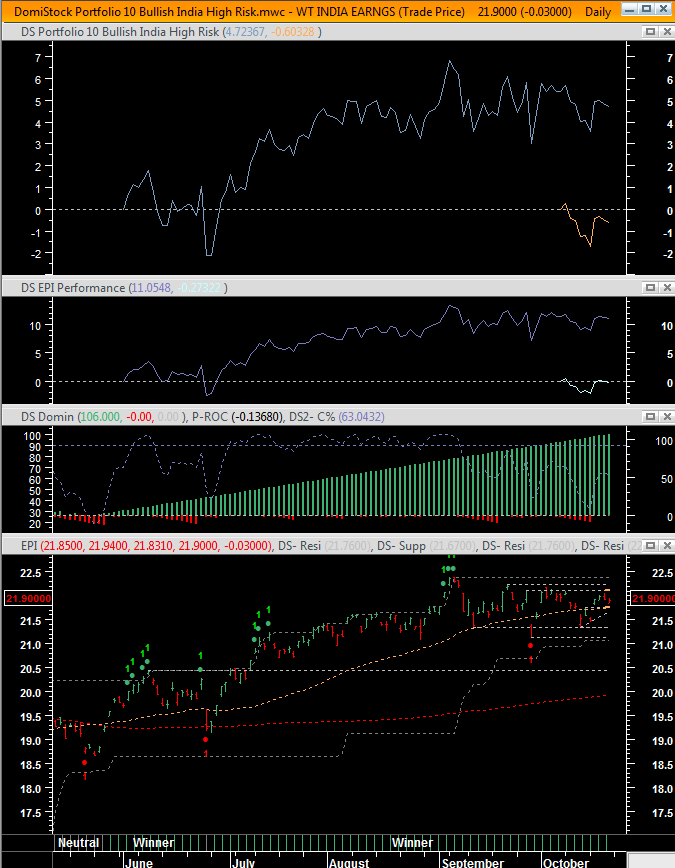

Portfolio 10: Bullish, India, High Risk

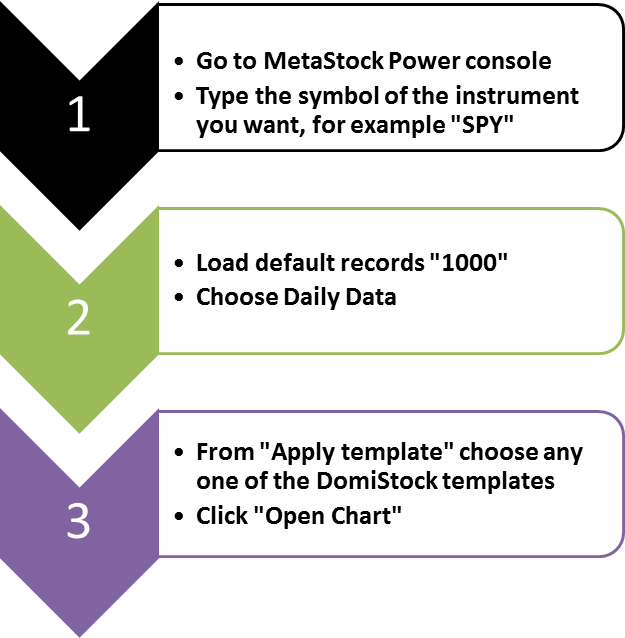

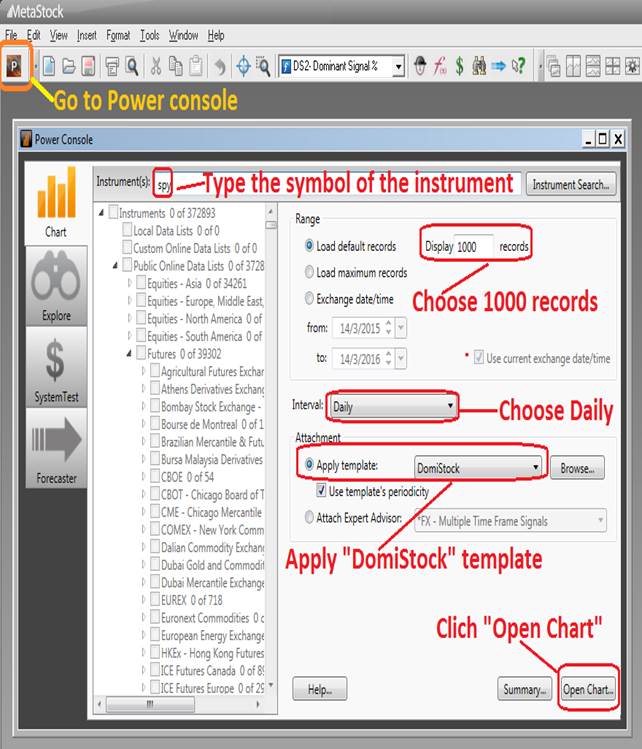

How to Open DomiStock

About the designer, Panos Panagiotou

Panos is a financial market software designer, a financial technical analyst and a writer. Software designed by Panos is used by thousands of private investors. The automated stock analysis system “3F” that he designed when he was 24 years old, became a European best seller in the 2000s, while his latest system, “DomiStock”, is launched as an add on to the award winning technical analysis software, “MetaStock” and was the Robo-Advisor of choice in the international research Behavioral Finance project “Robo-Advisors and Individual Investors”, conducted at Columbia University, New York, in fall 2015*.

Panos has been publishing financial market commentary and research for over two decades and has authored several books and e-books. His analysis and research has been published in Bloomberg, The Economist, BBC, NHK (Japan) and a plethora of European Media. He is a frequent commentator in economic and financial TV and radio shows.

Panos has done research in the incorporation of quantitative analysis and of mathematical, statistical and computational models into technical analysis and has educated private and professional investors from all over the world. In 2010 he received a lifetime achievement award at the 8th PanHellenic Financial and Investment Conference for his outstanding contribution in the field of technical analysis.

Panos studied Mathematics for Finance in Portsmouth University, U.K. and Law in Democritus University, Greece. He holds several certificates / diplomas obtained online and among others in: Financial Engineering and Risk Management – Columbia University, Asset Pricing – The University of Chicago, Advanced Statistics – Harvard University, Macro-econometric Forecasting – IMF, International Monetary Fund, Commercial Real Estate Analysis – Moody’s, Economics of Money and Banking – Columbia University, Statistics for Data Science and Analytics – Columbia University, Financial Markets – Yale University, “The Analytics Edge” – MIT, Massachusetts Institute of Technology. Panos holds a certificate in technical analysis after completing one of the few online courses taught by the internationally acknowledged technical analyst John Murphy.

John Murphy’s letter to Panos

Dear Panos

I am happy to see that my work has had a positive influence on your work and your career. I

am also very honored that you would dedicate your award to me. Thank you very much.

I would like to wish you the best of success in your career.

Regards,

John Murphy

New Jersey, 11/12/2001

* Master of Science in Financial Engineering, Department of Industrial Engineering and Operations Research

Appendix 1

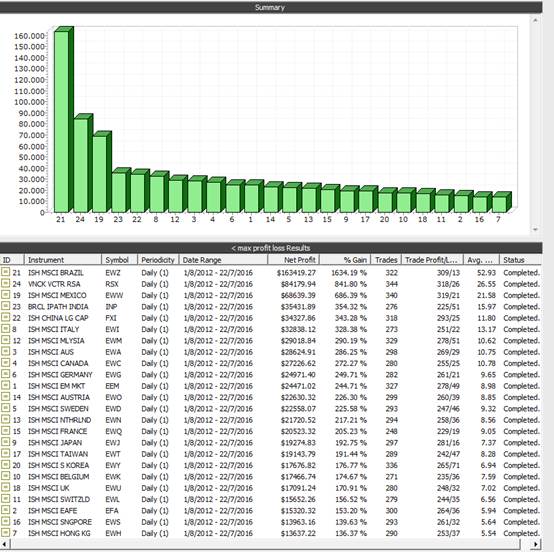

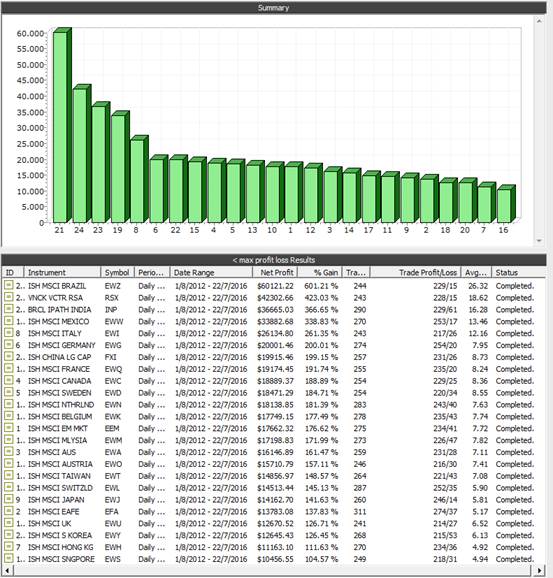

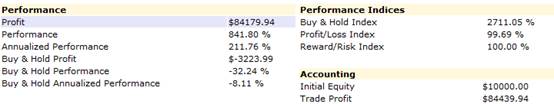

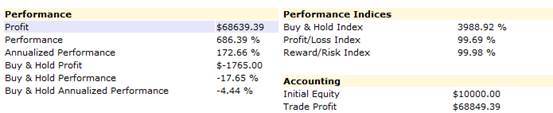

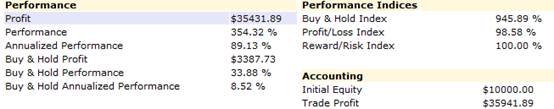

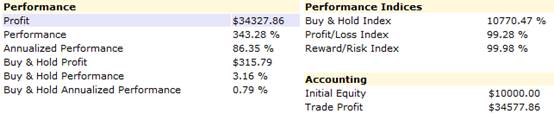

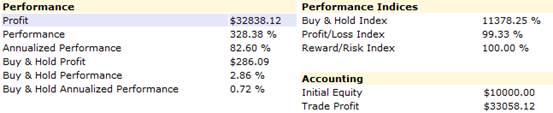

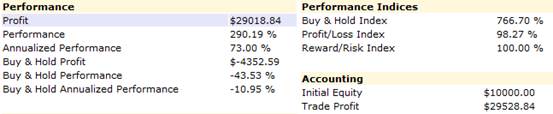

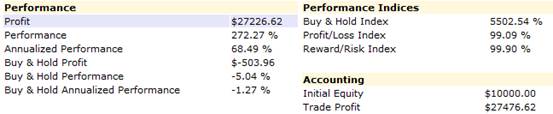

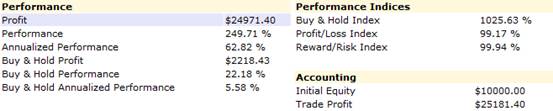

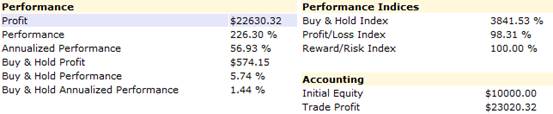

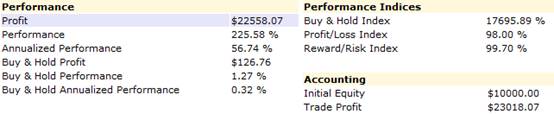

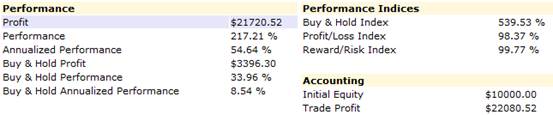

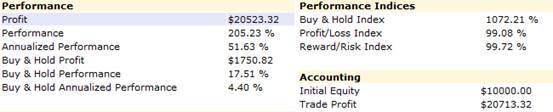

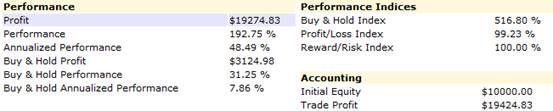

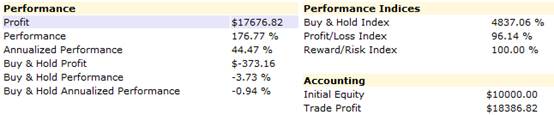

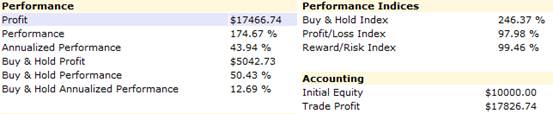

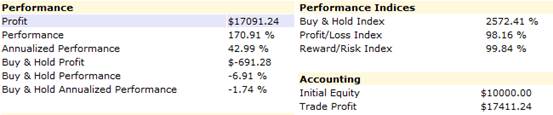

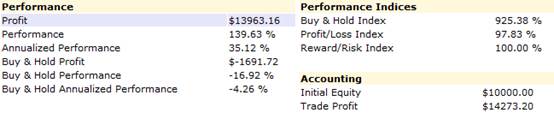

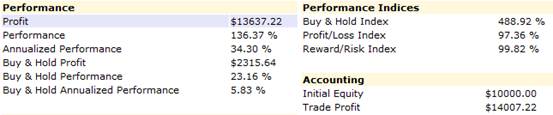

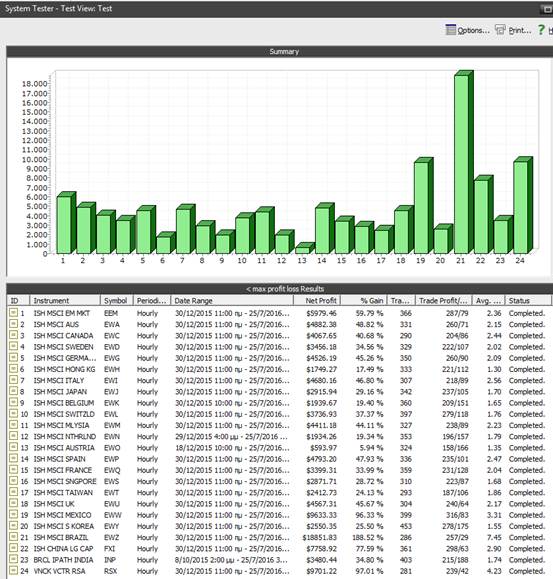

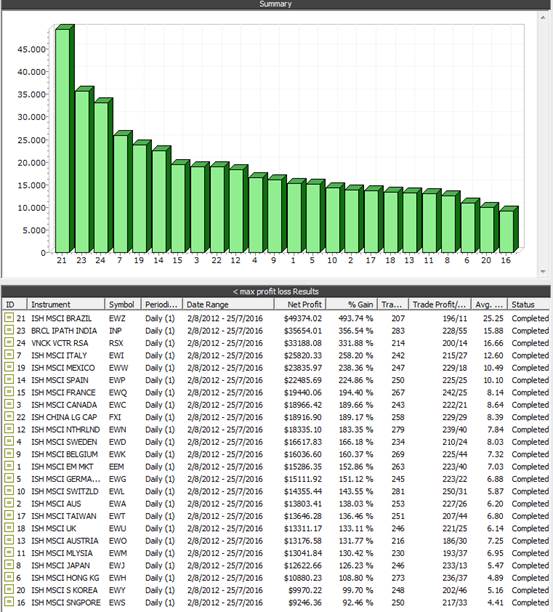

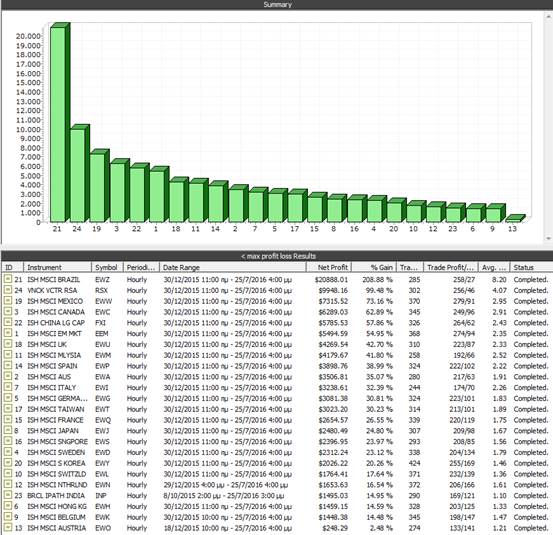

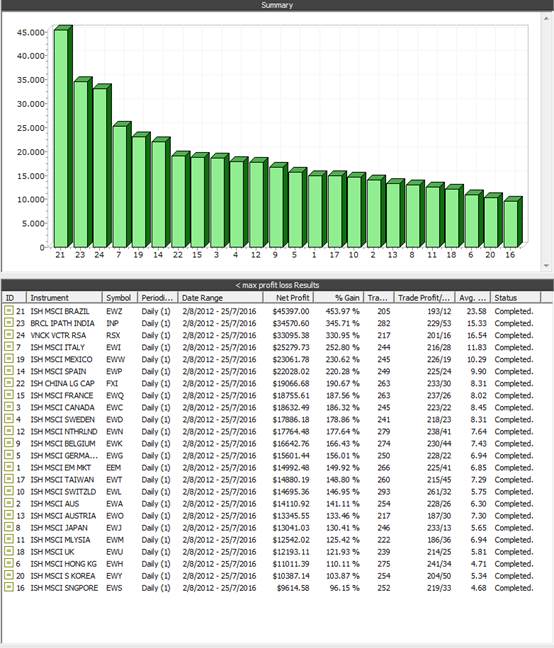

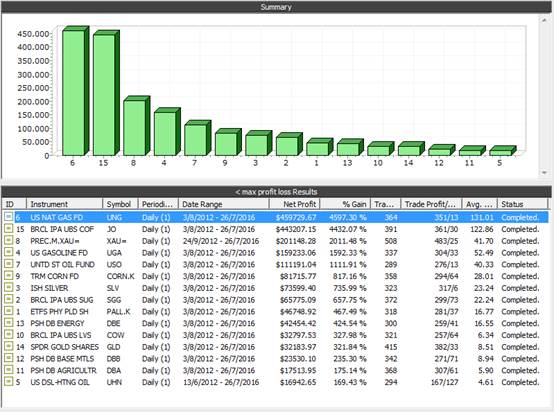

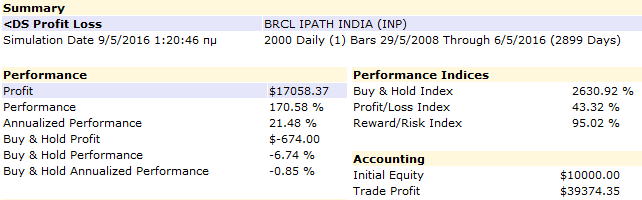

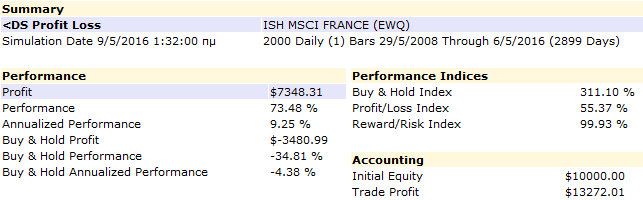

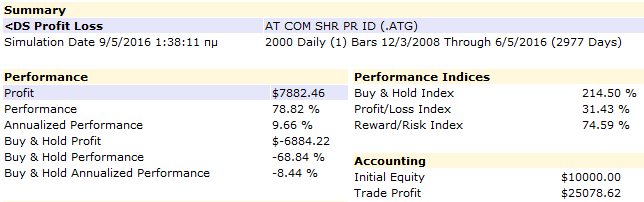

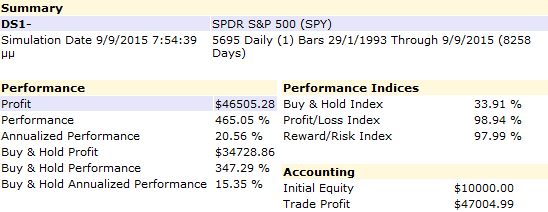

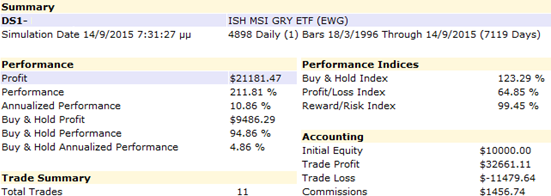

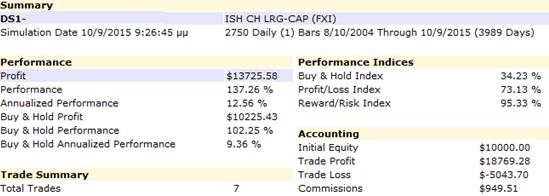

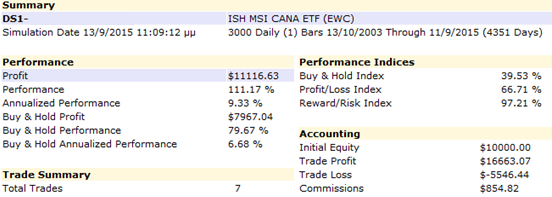

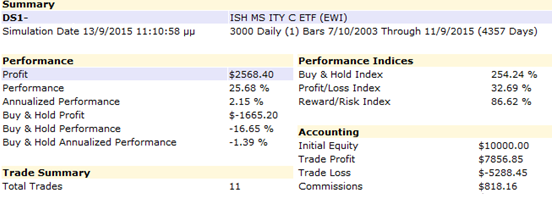

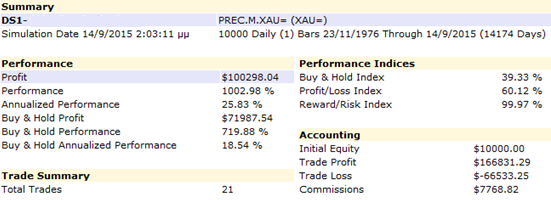

Simulation Results and Statistics Screenshots from MetaStock System Tester of a combined use of the algorithms of Max Profit – Loss Calculator, Dominant – Hedging Signal System and Winner, Loser, Neutral Indicator. Only long signals were used, with a profit taking order. Commissions were set at $5 per trade. Hedging trades are counted as full trades. Several simulations for the same instruments were done with a variety of choices of periods for the Max Profit – Loss Calculator.

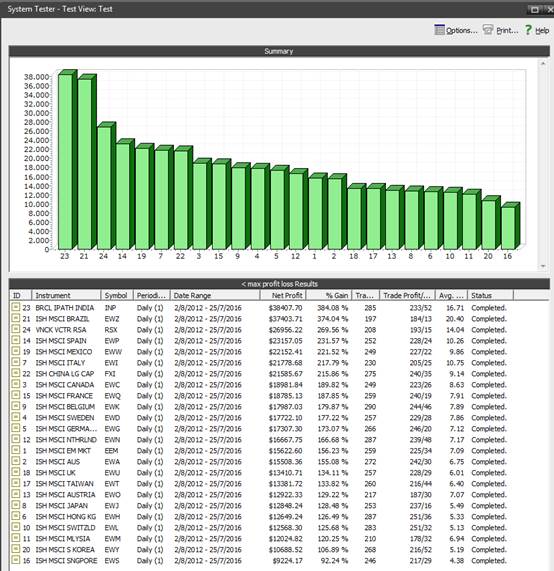

SIMULATION PERIOD: 1/08/12 – 22/07/16

(Input: 21-50 periods), Daily Data

American Indices

Asia/Pacific Indices

Africa/Middle East Indices (& ETFs)

INTERNATIONAL INDICES SPDRS (ETFs)

PERIOD: 1/08/12 – 22/07/16,

(Input: 1-10 periods), Daily Data

BRAZIL (EWZ)

RUSSIA (EWZ)

MEXICO (EWW)

INDIA (INP)

CHINA (FXI)

ITALY (EWI)

MALAYSIA (EWM)

AUSTRALIA (EWA)

CANADA (EWC)

GERMANY (EWG)

EMERGING MARKETS (EEM)

AUSTRIA (EWO)

SWEDEN (EWD)

NETHERLANDS (EWN)

FRANCE (EWQ)

JAPAN (EWJ)

TAIWAN (EWT)

SOUTH KOREA (EWY)

BELGIUM (EWK)

UNITED KINGDOM (EWU)

SWITZERLAND (EWL)

SINGAPORE (EWS)

HONG KONG (EWH)

INTERNATIONAL INDICES SPDRS (ETFs)

SIMULATION PERIOD: 1/08/12 – 25/07/16,

(Input: 1-10 periods), 60 min Data

INTERNATIONAL INDICES SPDRS (ETFs)

SIMULATION PERIOD: 1/08/12 – 25/07/16,

(Input: 11-20 periods), Daily Data

INTERNATIONAL INDICES SPDRS (ETFs)

SIMULATION PERIOD: 1/08/12 – 22/07/16,

(Input: 11-20 periods), 60 min Data

INTERNATIONAL INDICES SPDRS (ETFs)

SIMULATION PERIOD: 1/08/12 – 25/07/16,

(Input: 21-30 periods), Daily Data

INTERNATIONAL INDICES SPDRS (ETFs)

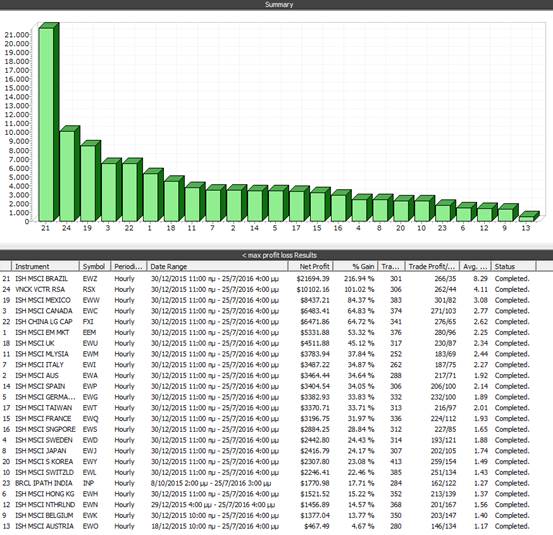

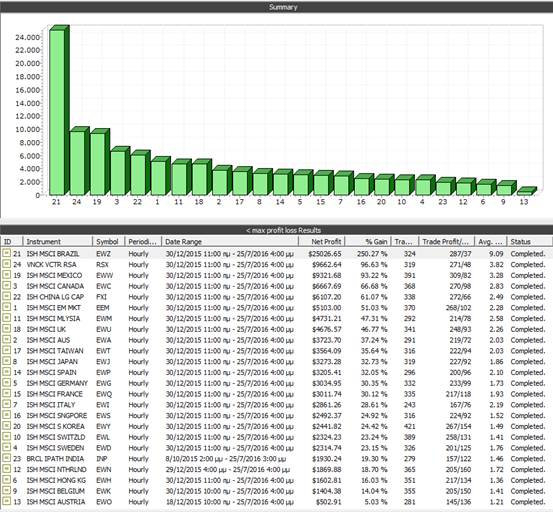

SIMULATION PERIOD: 30/12/15 – 25/07/16,

(Input: 21-30 periods), 60 min Data

INTERNATIONAL INDICES SPDRS (ETFs)

SIMULATION PERIOD: 1/08/12 – 25/07/16,

(Input: 30-50 periods), Daily Data

INTERNATIONAL INDICES SPDRS (ETFs)

SIMULATION PERIOD: 30/12/15 – 25/07/16,

(Input: 30-50 periods), 60 min Data

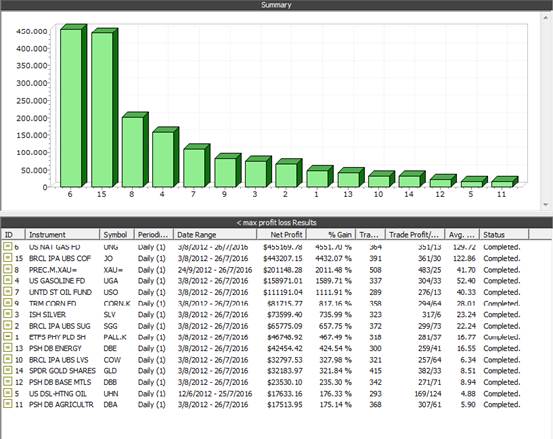

US COMMODITIES

SIMULATION PERIOD: 3/08/12 – 26/07/16,

(Input: 30-50 periods), Daily Data

US COMMODITIES

SIMULATION PERIOD: 3/08/12 – 26/07/16,

(Input: 21-30 periods), Daily Data

US COMMODITIES

MAX PROFIT – LOSS, SIMULATION PERIOD: 3/08/12 – 26/07/16,

(Input: 1-20 periods), Daily Data

FOREX

MAX PROFIT – LOSS, SIMULATION PERIOD: 27/09/12 – 27/07/16,

(Input: 1-20 periods), Daily Data

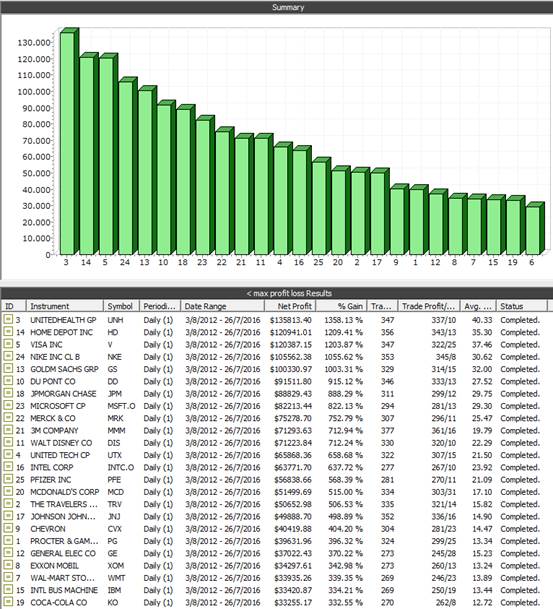

US: DOW JONES CONSTITUENTS

MAX PROFIT – LOSS, SIMULATION PERIOD: 3/08/12 – 26/07/16,

(Input: 1-20 periods), Daily Data

Simulation Results and Statistics Screenshots from MetaStock System Tester of the algorithm DomiStock uses for the Winner, Loser, Neutral indicator. Only long signals taken, without any profit taking order. Commissions are set at $5 per trade.

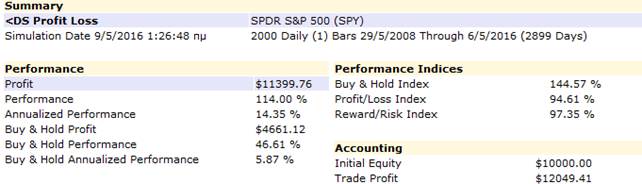

Appendix 2

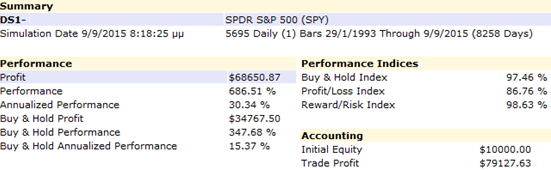

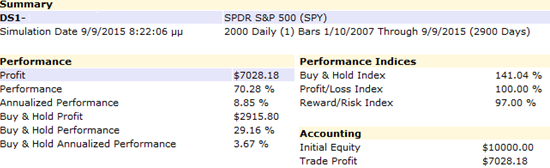

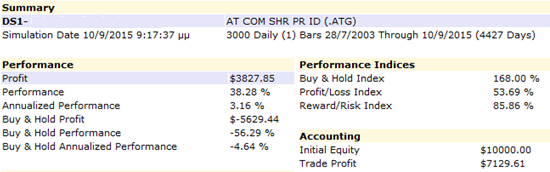

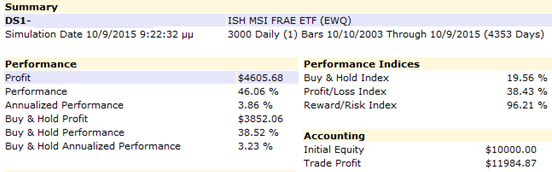

Simulation Results and Statistics Screenshots from MetaStock System Tester of the indicator DomiStock uses for the long cycle recognition.

Simulation 1: SPY Long Positions (S&P 500 SPDR – US)

Simulation 2: SPY Long & Short Positions (US)

Simulation 3: SPY Long Positions (US)

Simulation 4: QQQ.O Long Positions (Nasdaq SPDR – US)

Simulation 5:.ATG Long Positions (Greece)

Simulation 6: EWQ Long Positions (France)

Simulation 7: EWG Long Positions (Germany SPDR)

Simulation 8: FXI Long Positions (China SPDR)

EWU Long Positions (UK SPDR)

Simulation 9: EWC Long Positions (Canada SPDR)

Simulation 10: EWI Long Positions (Italy SPDR)

Simulation 11: EWA Long Positions (Australia SPDR)

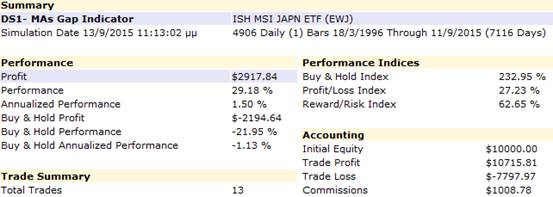

Simulation 12: EWJ Long Positions (Japan SPDR)

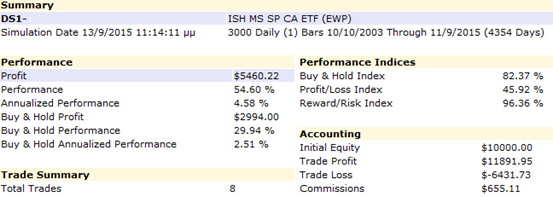

Simulation 13: EWP Long Positions (Spain SPDR)

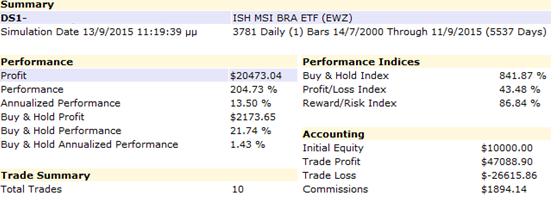

Simulation 14: EWZ Long Positions (Brazil SPDR)

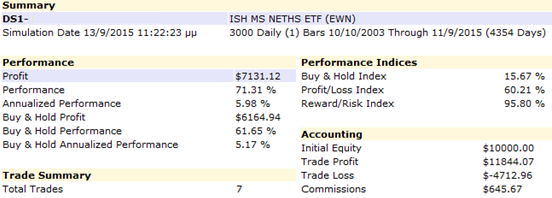

Simulation 16: EWN Long Positions (Netherlands SPDR)

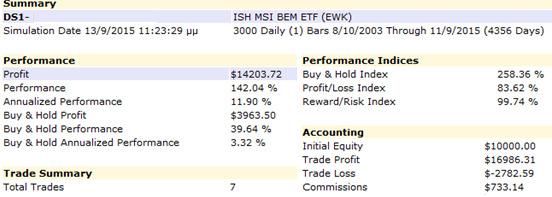

Simulation 17: EWK Long Positions (Belgium SPDR)

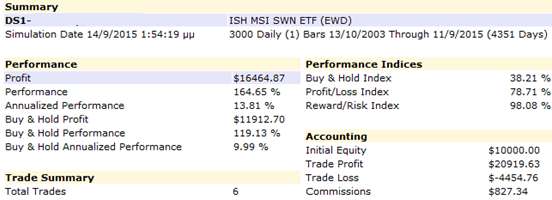

Simulation 18: EWD Long Positions (Sweden SPDR)

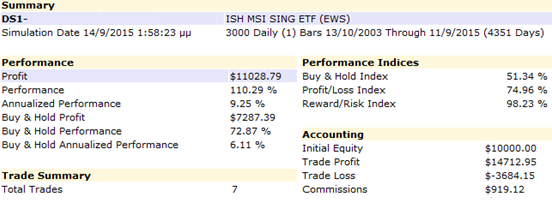

Simulation 20: EWS Long Positions (Singapore SPDR)

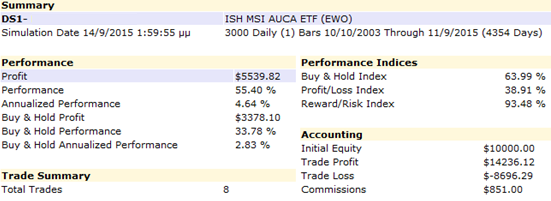

Simulation 21: EWO Long Positions (Austria SPDR)

Simulation 22: EIS Long Positions (Israel SPDR)

Simulation 23: XAU= Long Positions (Gold)

Legal Information

Past performance does not guarantee future results. All investing involves risk. The material contained in this manual is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument. The investments and strategies discussed may not be suitable for all investors; check with your financial advisor or broker-dealer. Our commentaries should not be considered to be recommendations to buy, sell or hold any security or investment, and no one should rely upon our commentaries as research or investment advice.

This is neither a solicitation to buy or sell any type of financial instruments, nor intended as investment recommendations. All investment trading involves multiple substantial risks of monetary loss. Don’t trade with money you can’t afford to lose. Trading is not suitable for everyone. Past performance, whether indicated by actual or hypothetical results or testimonials are no guarantee of future performance or success. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS OR TESTIMONIALS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. Furthermore, all internal and external computer and software systems are not fail-safe. Have contingency plans in place for such occasions. Panos Panagiotou and/or Panagiotou Ltd assume no responsibility for errors, inaccuracies, or omissions in these materials, nor shall it be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenue, or lost profits, that may result from reliance upon the information materials presented.

Terms of Use

AGREEMENT. This product “DomiStock”, is owned by Panagiotis (Panos) Panagiotou and Panagiotou Ltd. and is offered to you conditioned on your acceptance without modification of the terms, conditions and notices contained herein. By accessing and using this product through MetaStock Xenith or in other way including through other services such as seminars, webinars, or content included in websites or elsewhere.” is, you are deemed to have agreed to all such terms, conditions, and notices.

ACCURACY OF INFORMATION. All of the services and information provided here are for entertainment and educational purposes only. While the information is believed to be accurate and the analysis is honestly offered, none of the information provided should be considered solely reliable for use in making actual investment decisions. Panagiotou Ltd. None of the information provided is guaranteed to be accurate, complete, useful or timely. Panagiotou Ltd., and its third-party providers do not warrant or guarantee such accuracy, completeness, usefulness or timelines.

DISCLAIMER. PANAGIOTIS PANAGIOTOU AND PANAGIOTOU LTD., AND ITS THIRD-PARTY PROVIDERS MAKE NO REPRESENTATIONS ABOUT THE SUITABILITY OF THE SERVICES OR INFORMATION PROVIDED HERE FOR ANY PURPOSE. ALL SUCH SERVICES AND INFORMATION ARE PROVIDED “AS IS” AND “AS AVAILABLE” WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED. PANAGIOTOU LTD., HEREBY DISCLAIMS ALL WARRANTIES WITH REGARD TO THE SERVICES AND INFORMATION, INCLUDING ALL IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, TITLE AND NON-INFRINGEMENT OTHER THAN THOSE WARRANTIES WHICH ARE IMPLIED BY AND INCAPABLE OF EXCLUSION, RESTRICTION OR MODIFICATION UNDER THE LAWS APPLICABLE TO THIS AGREEMENT. PANAGIOTOU LTD DOES NOT WARRANT THAT THE INFORMATION WILL BE UNINTERRUPTED OR ERROR-FREE, THAT DEFECTS WILL BE CORRECTED, OR THAT THIS PRODUCT OR THE SERVER THAT MAKES IT AVAILABLE, ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS.

LIMITATION OF LIABILITY. Under no circumstances shall Panagiotis Panagiotou or Panagiotou Ltd., its officers, directors, shareholders agents or its third-party providers be liable for any direct, indirect, incidental, punitive, special or consequential damages (including without limitation, attorneys’ fees), whether in an action of contract, negligence or other torturous action, that result from the use of, or the inability to use, any materials available here, even if Panagiotis Panagiotou or Panagiotou Ltd., has been advised of such damages. If you are dissatisfied with any DomiStock Information or other materials, or with any of the terms and conditions provided here, your sole and exclusive remedy is to discontinue using DomiStock. If Panagiotis Panagiotou or Panagiotou Ltd. or any of its third-party providers are found liable in connection with a claim arising out of or related to the services or the Information, their aggregate liability in such an event shall not exceed the amount of the fees paid by you for use of the service during the month in which the event giving rise to the liability occurred. Your right to monetary damages in such amount shall be in lieu of all other remedies to which you may otherwise be entitled from Panagiotis Panagiotou or Panagiotou Ltd. or its third-party providers.

INVESTMENT DECISIONS. You assume all risk associated with investment decisions made on the basis of information contained on this service. It is our policy to never advocate the purchase or sale of any individual investment vehicle. You should also understand that Panagiotis Panagiotou and Panagiotou Ltd, its third-party providers and their respective officers, directors and employees may be active investors in the market and may or may not have open positions in any investment vehicle mentioned on this service. Prior to the execution of a stock trade, you are advised to consult with your broker or other financial representative to verify pricing and other information. Panagiotis Panagiotou and Panagiotou Ltd, it’s third-party providers, or content partners shall have no liability for investment decisions based upon the Information.

RESTRICTIONS ON USE. All materials published by Panagiotis Panagiotou and Panagiotou Ltd., including, but not limited to charts, images, illustrations, price information, reviews, analysis and email newsletters (“Information”) are protected by copyright, and owned or controlled by Panagiotis Panagiotou and Panagiotou Ltd. or it’s third-party providers. You must access the information manually by request and not programmatically by macro or other automated means. You may not use the contents for any unlawful purpose.

LIMITED LICENSE. Use of Information available from DomiStock is for informational and non-commercial or personal use only, No part of the Information available from DomiStock may be copied, photocopied, reproduced, republished, licensed, distributed, performed, displayed, uploaded, posted, translated, altered, retransmitted, broadcast in any way, exploited, used to create derivative works, or reduced to any electronic medium or machine-readable form, in whole or in part, without the prior written consent of Panagiotou Ltd., or its third-party providers. Any distribution for commercial purposes is strictly prohibited.

COPYRIGHT NOTICE. Except where indicated, all content provided from DomiStock is Copyright by Panagiotis Panagiotou and / or Panagiotou Ltd., All rights reserved.

MODIFICATION OF THESE TERMS AND CONDITIONS. Panagiotou Ltd., reserves the right to change this Terms of Service agreement at any time by revising the terms and conditions herein. You are responsible for regularly reviewing these terms and conditions. Such changes, modifications, additions or deletions shall be effective immediately upon publishing. Continued use of DomiStock following any such changes shall constitute your acceptance of such changes.

GENERAL. This agreement is governed by the laws of the United Kingdom (England). You consent to the exclusive jurisdiction and venue of courts in London, U.K. in all disputes arising out of or relating to the use of DomiStock. Use of DomiStock is unauthorized in any jurisdiction that does not give effect to all provisions of these terms and conditions, including without limitation this paragraph.

SEVERABILITY. If any part of this Agreement is determined to be invalid or unenforceable pursuant to applicable law including, but not limited to, the warranty disclaimers and liability limitations set forth above, then the invalid or unenforceable provision will be deemed superseded by a valid, enforceable provision that most closely matches the intent of the original provision and the remainder of the Agreement shall continue in effect.

ENTIRE AGREEMENT. This agreement constitutes the entire agreement between you and Panagiotis Panagiotou and Panagiotou Ltd., with respect to this DomiStock product and it supersedes all prior or contemporaneous communications and proposals, whether electronic, oral or written, between you and Panagiotis Panagiotou and Panagiotou Ltd., with respect to this DomiStock product. A printed version of this agreement and of any notice given in electronic form will be admissible in judicial or administrative proceedings based upon or relating to this agreement to the same extent and subject to the same conditions as other business documents and records originally generated and maintained in printed form.