Domistock Tools Used:

Assets charted: Crude Oil (CLc1)

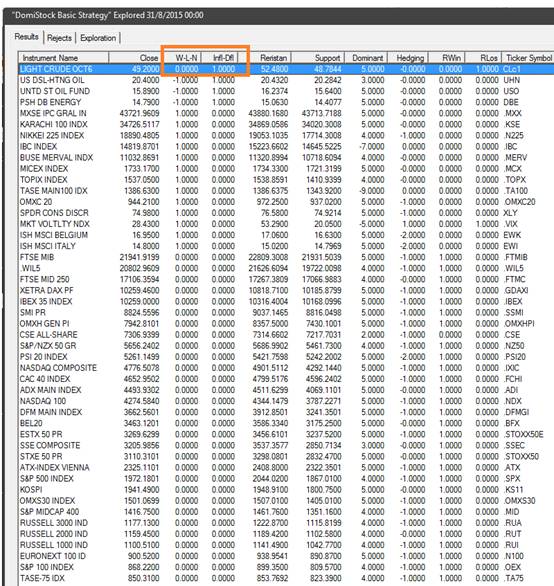

In search for trading opportunities around the globe I used DomiStock’s Basic Strategy Exploration to scan over 80 of the world’s most important stock indices and 26 of the top international ETFs and also the most important commodities’ indices and ETFs. After sorting the results by column C (Inflated-Deflated) the asset on the top of the list was Light Crude, which is a candidate for the “Long the Deflated Neutral” strategy. Light Crude is also a Recent Loser (see the last column of the exploration’s table). That makes it potentially inflated in the medium term and is an additional negative technical sign. Now, for a closer look at CLc1 lets chart it using the DomiStock Fast template.

In DomiStock’s quick manual we read that the “Short the Deflated Neutral” strategy “is of medium to high risk and looks to short securities that:

1. Are neutrals

2. Are inflated

3. Are testing / failing important resistance levels

4. Have a negative Dominant or Hedging Signal

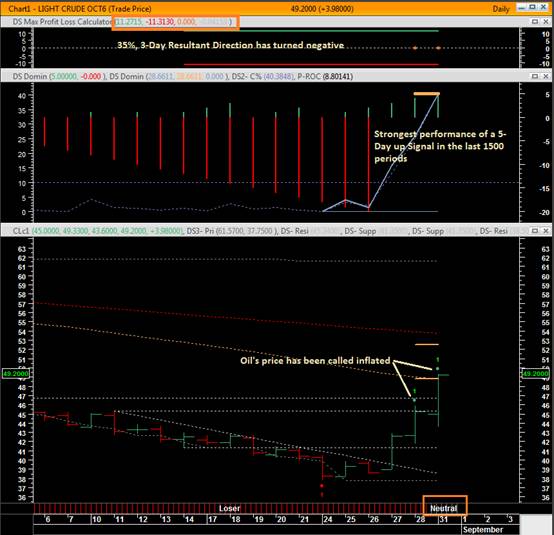

By applying the DomiStock Fast template on Crude Oil’s price we can see that a) it’s a Neutral, b) it’s inflated and c) it’s just a hair above its 50-day Moving Average, hence it’s still testing it as resistance. So three out of four prerequisites of the “Short the Inflated Neutral” strategy apply in this case. Additionally, the 35%, 3-Day Resultant Direction of the Max Profit Loss Calculator has turned negative, indicating a potential weakening of the supply forces. That is after DomiStock’s 5-day “go long” signal for oil, recorded the highest performance in the last 1500 periods, supporting the case for a statistically extreme and potentially overextended rally. Yet, what is still missing is a negative Dominant or Hedging signal and one could wait till that is given, even on an hourly chart. However, this doesn’t mean that one cannot place a short trade before getting a negative signal. It’s just that the risk in this case should be higher, as might be the profit. If such a short trade is taken, the stop loss could be set at 52,48 where the nearest resistance level stands.