Domistock Tools Used:

Assets charted: GBP=

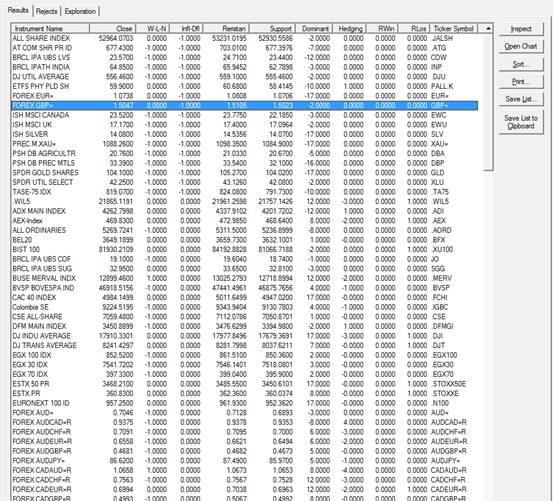

In search for trading opportunities around the globe I used DomiStock’s Basic Strategy Exploration to scan over 170 of the worlds’ top assets, including commodities, FOREX, international indices, US sectors ETFs and the top 25 countries’ ETFs. After sorting the results by column C (Inflated-Deflated), the asset that caught my attention the most was the GBP/USD (GBP=), which came up as a candidate for the “Long the Deflated Neutral” strategy.

In DomiStock’s quick manual we read that the “Long the Deflated Neutral” strategy “is of medium to high risk and looks to long securities that:

1. Are neutrals

2. Are deflated

3. Are testing / holding important support levels

4. Have a positive Dominant or Hedging Signal

By applying the DomiStock Fast template on GBP= price we can see that the first two conditions of the “Long the Deflated Neutral” are met (it’s a Neutral and it’s deflated) but the last two don’t (it has breached support and it’s on negative signal mode). In such a case there are three main options:

1. wait until all conditions are met, i.e. until GBP= returns above the breached resistance and until a positive signal is provided

2. asses a riskier strategy and turn to an hourly data chart to see if any of conditions 3 and 4 are fulfilled there.

3. get even more risky and open o position based on just the first two conditions met, managing the risk with a careful stop loss (which should anyway always be the case)

By turning to an hourly – data chart, we can see that GBP= tests support at 1.52010 and that a positive hedging signal is already intact. My choice is to follow option number 2 and open a long position by setting a stop loss just under the above mentioned support level.