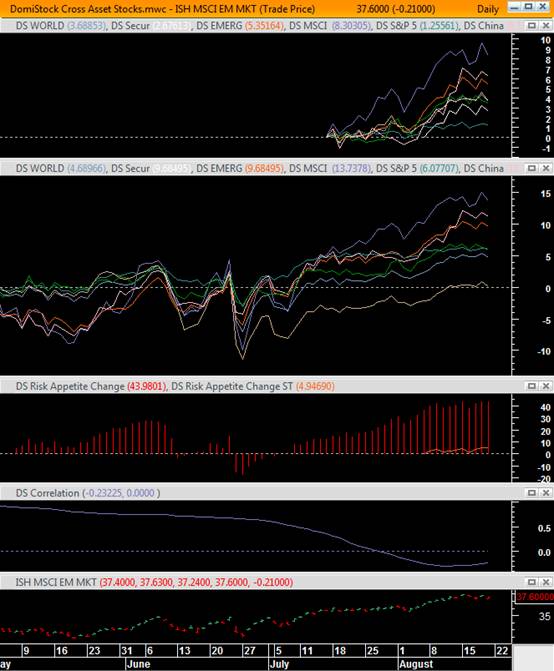

Domistock Tools Used:

Assets charted: EEM

Back in February I pointed to the strong correlation between oil and emerging markets and demonstrated DomiStock’s strong sings of a bottoming out in oil. The conclusion was that oil was about to start rising and that should have had a positive effect on emerging markets as well. A few months later oil has almost doubled its price and emerging markets have had an amazing run. So what now that oil’s rise seems to have run its course? Does that mean a drop for emerging markets as well? Not necessarily. That’s because back in February oil and emerging markets where tied together in a strong, positive correlation which now has completely broken and turned to a mild negative correlation. That suggests that a falling oil doesn’t have the effect it used to have on emerging markets. Hence, it can’t stop them from keep rising.